R&E Capitalization is Still Here — What Should You Do if Change Isn’t Coming?

Despite bipartisan support, there have been no revisions to the Internal Revenue Code (IRC) Section 174 rules requiring that research and experimentation (R&E) expenditures be capitalized and amortized. Although a policy change that would have postponed this requirement to the 2026 tax year was proposed in last year’s Build Back Better Act (BBBA), that change was never enacted due to the BBBA stalling in the Senate. Subsequent to the BBBA, no other bills – including the Consolidated Appropriations Act (CAA), the final large legislation of 2022 – has been successful in incorporating Section 174 changes into their final versions.

What is the policy now? Well, the Tax Cuts and Jobs Act (TCJA) of 2017 changed the treatment of R&E costs so that taxpayers must capitalize all R&E costs incurred after December 31, 2021, and amortize them over either a five-year period (domestic costs) or a 15-year period (foreign costs). Previously, taxpayers could either (1) immediately deduct R&E expenditures, or (2) elect to amortize those costs over a period of five or more years, which gave the taxpayer the ability to choose the option that would be the most beneficial for them.

While it is still possible for the legislative process to postpone or repeal mandatory capitalization of Section 174 costs (including retroactively applying any changes to the 2022 tax year), such legislation would need to have bipartisan support due to the currently divided Congress.

In this article, we review what it would mean for your business if the much-anticipated revisions to Section 174 do not occur, and what kind of planning you should do to prepare on the front end. A number of these recommendations will be further refined once additional IRS guidance is provided.

Background on 174 R&E expenditures

R&E expenses for income tax purposes are defined under Section 174 and its regulations. In Treasury Regulation Section 1.174-2(a), R&E expenditures are described as expenditures incurred by the taxpayer in connection with the taxpayer’s trade or business in the experimental or laboratory sense. Section 174(c)(3) – added by the TCJA – also notes that any amount paid or incurred in connection with the development of any software shall also be an R&E expenditure subject to capitalization. Generally, when determining R&E expenses, not only are direct costs of R&E factored in, but also the indirect costs incident to the development or improvement of a product.

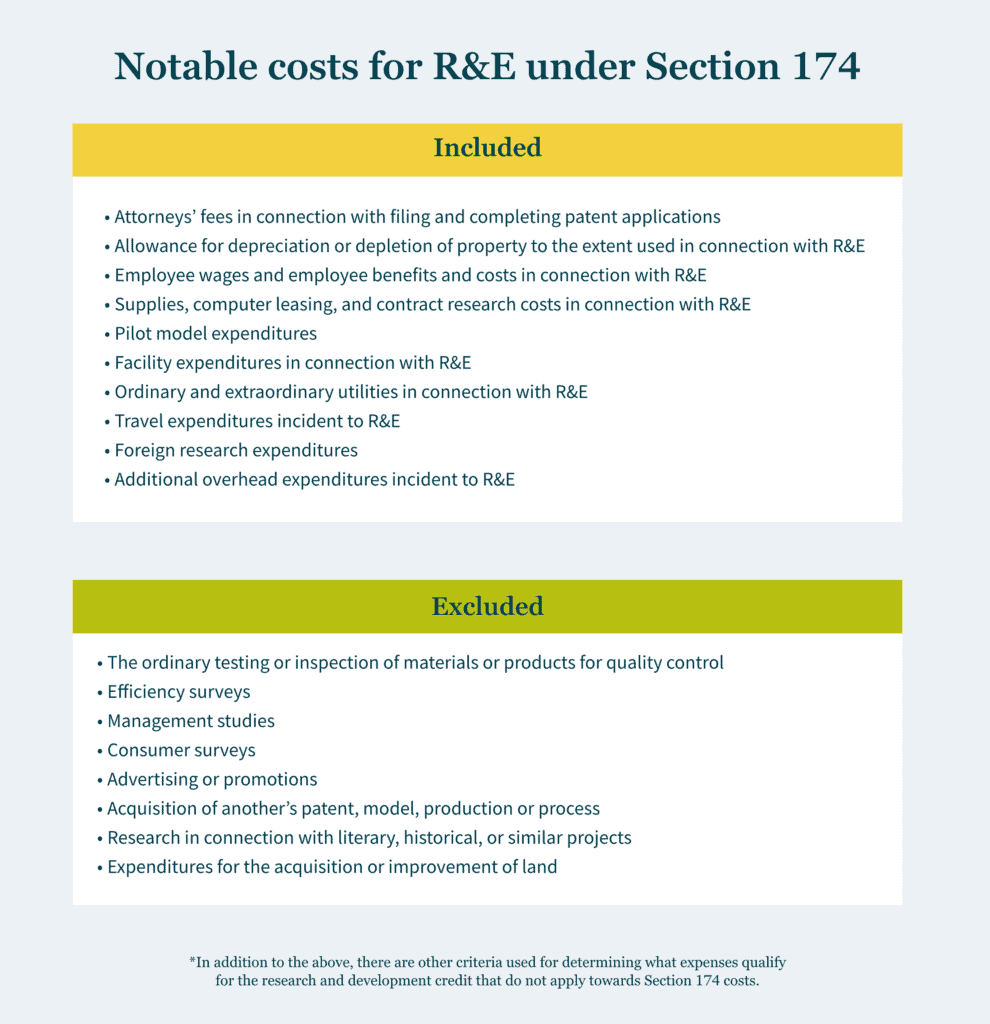

Common expenses included in R&E costs under Section 174 are the following. Many of these expenses are considered for Section 174 specifically and are not qualified research expenses for purposes of the R&D credit.

- Attorneys’ fees in connection with filing and completing patent applications.

- Allowance for depreciation or depletion of property to the extent used in connection with R&E.

- Employee wages and employee benefits and costs in connection with R&E.

- Supplies, computer leasing, and contract research costs in connection with R&E.

- Pilot model expenditures.

- Facility expenditures in connection with R&E.

- Ordinary and extraordinary utilities in connection with R&E.

- Travel expenditures incident to R&E.

- Foreign research expenditures.

- Additional overhead expenditures incident to R&E.

*In addition to the above, there are other criteria used for determining what expenses qualify for the R&D credit that do not apply towards determining Section 174 costs.

In contrast, the following are common expenses that are excluded from the expansive definition of R&E costs under Section 174:

- the ordinary testing or inspection of materials or products for quality control;

- efficiency surveys;

- management studies;

- consumer surveys;

- advertising or promotions;

- acquisition of another's patent, model, production or process;

- research in connection with literary, historical, or similar projects; and

- expenditures for the acquisition or improvement of land.

The current R&E amortization rule explained

The ability to deduct R&E costs changed for all tax years beginning after December 31, 2021. As previously mentioned, these costs can no longer be deducted in full and must be capitalized and then amortized over five years for domestic costs and over 15 years for foreign costs. This amortization starts at the midpoint of the first year that the expenses were incurred, which results in only 10% of domestic costs (1/2 of 20%) being able to be deducted in their first year.

Per IRS guidance, this mandatory change can be implemented as an automatic accounting method change through attaching a statement to a taxpayer’s first income tax return with a year beginning after 2021, in lieu of filing the much more intricate Form 3115. This change should not have an effect on prior tax years, since the automatic method change is implemented on a “cut-off basis."

Macro effect of mandatory capitalization

As mentioned above, before the prior rule was changed, every R&E expense could be deducted in full in the year they were incurred. While it is expected that the Section 174 expensing rules will revert to this — to some extent — through pressure from persistent lobbyists, this change has not been incorporated into a bill yet.

Some believe the mandatory R&E capitalization and amortization will adversely affect U.S. innovation, potentially resulting in a detrimental impact on our global competitiveness and jobs. For more than 60 years, businesses were able to immediately deduct their R&D expenses in the year those expenses were incurred (or choose to defer based on what worked for them). Now, the amortization of new R&E costs could cost businesses billions in cash taxes.

Significant considerations

Estimated Tax Payments: For taxpayers making estimated tax payments utilizing current year taxable income, consideration should be given to R&E expenditures and how the capitalization of those expenditures may impact taxable income and timing of cash tax payments. A closer look at refining the various accounts in a taxpayer’s books may be needed for this.

Tax Accounting / ASC 740: Taxpayers should be mindful of whether a new deferred tax asset is created, if any adjustment of existing deferred taxes may be necessary, or if a full or partial valuation allowance may be needed.

Other Areas Affected: The amortization requirement also affects other areas of taxable income, including the following:

- increases the deductibility of business interest under Section 163(j),

- increases the deductibility of the QBI (Qualified Business Income) deduction,

- increases the amount of GILTI (global intangible low-taxed income) for controlled foreign corporations,

- potentially adjusts the amount of FDII (foreign derived intangible income) deduction that can be taken,

- changes the amount of R&E expenses allocable for purposes of the foreign tax credit, and

- impacts state taxable income for the few states that do not conform to the capitalization requirement (e.g., California).

R&D credit considerations

The Section 174 capitalization requirements should not directly impact the amount of expenses that can be used for the R&D Tax Credit under Section 41, since the research credit is calculated using a much smaller subset of R&E expenditures than Section 174 and is not limited by the capitalization requirement. As Section 174 is much broader in scope, it applies to expenditures both eligible and ineligible for the research credit.

Another consideration for tax planning is that the research credit will be even more important to assist with reducing the additional tax liability that will be generated by the R&E treatment change, since the credit can help offset some of the tax liability increase. Moreover, the analysis & processes used to determine the R&D credit can be leveraged to identify Section 174 R&E expenses, which helps create some efficiencies in quantifying the overall effect of the mandatory capitalization and amortization requirement.

Extend impacted returns where possible

Tax return extensions are highly recommended for tax returns that have their due dates coming up. Not only is there the pending IRS guidance that may significantly change R&E expense calculations, but also the act of extending tax returns should allow more time for tax returns to be superseded (rather than amended) and should allow for R&D credit claims to be made on originally filed returns.

This is echoed by a September 2021 Chief Counsel Memorandum issued by the IRS, which made the process for claiming a refund under the R&D credit far more stringent. The memorandum relayed that taxpayers must provide more information on business components, identify the research activities performed, and name the individuals who performed each research activity. Given the additional amount of detail needed, taxpayers making R&D credit claims on amended returns — especially small businesses — have a heavier burden than those who make the claim on an originally filed returns.

How will it affect you?

If the mandatory R&E capitalization requirement is not changed, you should consider how the 174 capitalization rules will affect your business and how claiming the R&D credit will help offset the increase in tax liability. If you currently have an R&D credit analysis and/or an ASC 730 financial statement analysis, those studies can be used as starting points to determine the overall effect of Section 174 — keeping in mind that neither analysis includes all the costs included in Section 174.

If the requirement is changed, there are several ways that the R&E expense landscape could turn out for taxpayers. Ideally, Congress will revert to the prior rule regarding R&D expenses. In that situation, you should be able to choose what is best for you — immediately deducting or deferring.

Our perspective

As experienced advisors, MGO can help model the best R&E position for you, through the 2022 tax year and beyond — potentially saving you significant amounts of money. Our holistic tax advisor and business advisor-first philosophy factors not only the direct effects of the R&E capitalization requirement, but also the impact on other areas of your tax returns (e.g., international, transfer pricing, state, and local tax) and what potential savings you can obtain by claiming the R&D credit. Please feel free to reach out to any of our R&E costing professionals below to get the experienced insight that you deserve.

About the author

Danielle Bradley is a senior manager in MGO's National Tax Credits and Incentives practice. She focuses on helping businesses identify, substantiate, and defend federal and state tax credits and incentives. She has helped hundreds of companies monetize and defend over $100 million in various tax credits and incentives, such as the Research and Development (R&D) Tax Credit, Orphan Drug Credit, Employee Retention Credit, meals and entertainment deduction, and the current Research and Experimental (R&E) amortization calculations. Danielle has extensive experience in various industries, including software and technology, life sciences, manufacturing, aerospace and defense, and food, beverage and agriculture businesses.

Contact Danielle to further discuss the R&E amortization or other credits and incentives at Danielle Bradley or Michael Silvio (Tax Partner).