How to Elevate Your Company’s IPE Documentation to Optimize SOX Compliance

By Jonathan Bayeff, CPA & Cesar Reynoso, CPA

Executive Summary:

- The Sarbanes-Oxley (SOX) Act established stricter financial reporting requirements for public companies, leading to increased scrutiny of Information Produced by the Entity (IPE).

- IPE carries different levels of risk depending on whether it is system-generated and manually prepared IPE. Strong documentation is key to validating completeness and accuracy of IPE.

- Best practices for IPE documentation include identifying the source, parameters, and format of reports; validating totals and counts; retaining screenshots; and having knowledgeable reviewers.

~

Passed by Congress in 2002, the Sarbanes-Oxley (SOX) Act revolutionized public company audits by introducing financial reporting requirements aimed at increasing transparency and preventing fraud. Most notably, the SOX Act established the Public Company Accounting Oversight Board (PCAOB), a nonprofit organization that oversees the audits of public companies to protect investors and further the public interest in the preparation of informative, accurate, and independent audit reports.

The PCAOB refines its auditing standards annually and, in recent years, the organization has placed greater scrutiny on the work of external auditors. To keep up with PCAOB compliance, external auditors have imposed more rigorous documentation requirements on companies. As a result, companies have felt pressure to provide more expansive Information Produced by the Entity (IPE).

If external auditors have applied greater scrutiny on your reporting, you may be wondering: What level of documentation is sufficient? How can you improve your documentation to avoid deficiencies and provide greater clarity? In this article, we will discuss: 1) what IPE is, 2) the risks associated with different IPE, and 3) how to document your IPE thoroughly.

What is IPE?

IPE is any information created by a company used as part of audit evidence. Audit evidence may be used to support an underlying internal control or as part of a substantive audit. Although there are documentation and risk severity differences between system-generated and manually prepared IPE, the fundamental questions that need to be addressed are the same:

- Is the data complete?

- Is the data accurate?

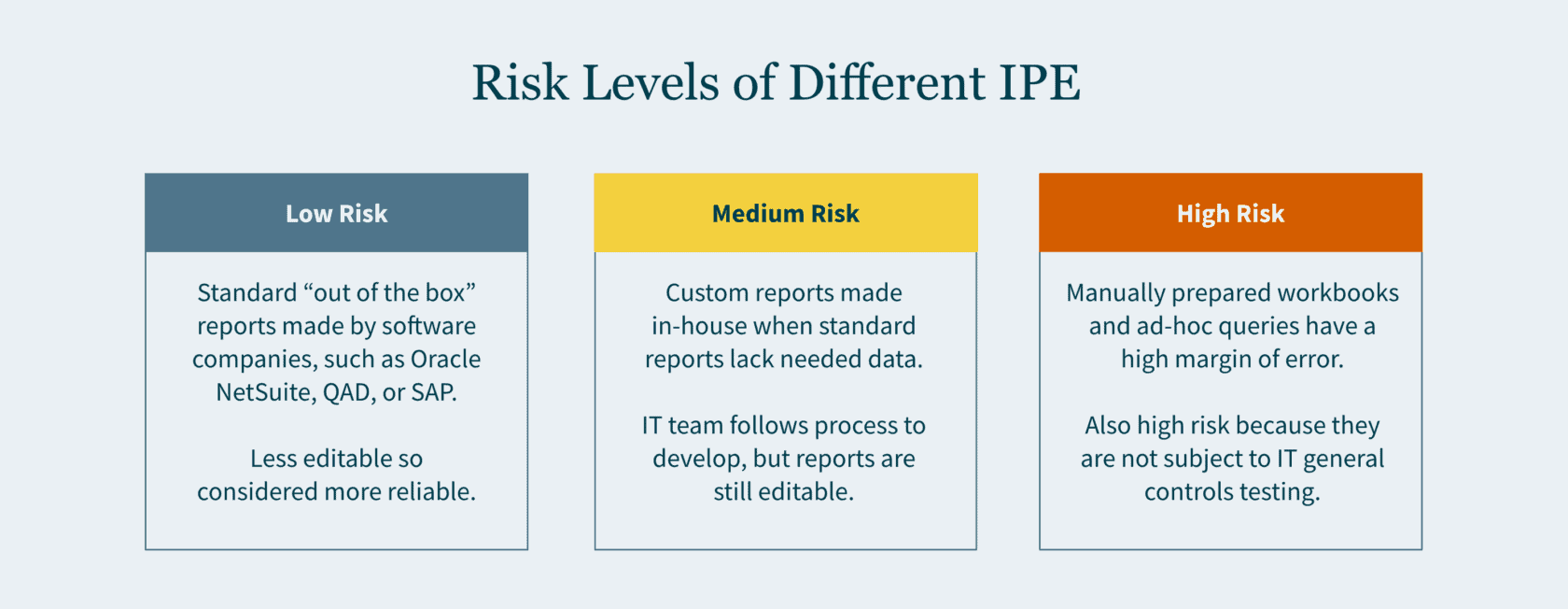

Risk Levels of Different IPE

Here is an overview of how risk levels vary for different types of information you report to auditors:

Low Risk

“Out of the box” reports carry the lowest risk. These reports are also referred to as “standard” or “canned” reports. Standard reports have been developed by software companies — such as Oracle NetSuite, QAD, or SAP — as part of their enterprise resource planning (ERP) systems. Typically, the end user (you) and even your IT team cannot modify these reports. Given the constrained editability, greater reliance is placed on these reports.

Medium Risk

Custom reports are typically driven by the business team and developed in-house by your company’s IT team. When your company’s ERP system does not have a report that would provide sufficient data, the in-house developers create a custom report. The IT team follows their change management process when developing the request report. If the report results do not align with your business team’s expectations, the query is refined, and the process is repeated until it does.

High Risk

A manually prepared workbook or an ad-hoc query are inherently the riskiest documentation. A manually prepared workbook may be a debt reconciliation prepared by your staff accountant, or a list of litigations the company is involved in drafted by your legal department. Given that these are manually drafted, the margin of error may be high.

An ad-hoc query is considered high risk since the report is not subject to IT General Controls (ITGC) testing. The end user may input any parameters to generate the report. Since no control testing is performed by your company, external auditors would need to rely on their own IT team to vet the nonstandard query.

How to Document IPE?

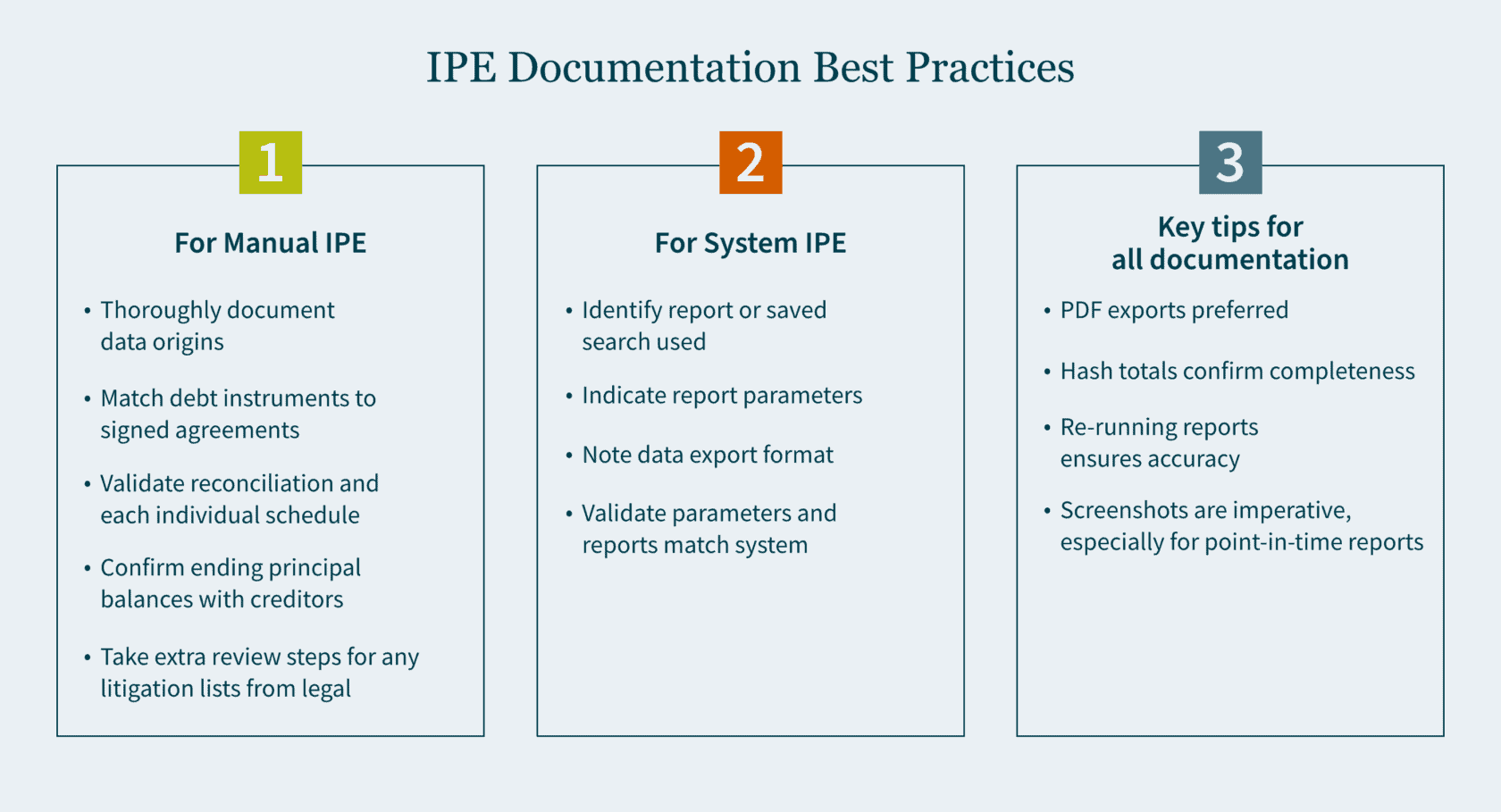

Your documentation will vary to a certain degree depending on whether the IPE is manually prepared or system generated. In either case, it is important to be as thorough as possible when documenting your procedures.

Manual IPE

For a manually prepared workbook, provide thorough documentation about the origins of the data. It is ideal to have someone who is privy to the information review the workbook.

When the reconciliation is comprised of debt instruments, the reviewer should do the following:

- Match the list of individual debt instruments to the signed agreements.

- Validate the reconciliation and each individual schedule for mathematical accuracy.

- Confirm ending principal balances with creditors (where possible).

If the list consists of litigations compiled by the legal department, the reviewer should do the following:

- Send confirmations to outside counsel (where possible).

- Obtain a list of commitments and contingency journal entries made to an accrual.

These additional steps provide greater comfort that the list compiled is complete and accurate.

System-Generated IPE

For system-generated IPE, there are a handful of questions to keep in mind:

- Have you identified the report or saved search that was used?

- What parameters were used to generate this report?

- In what format is the data exported?

- After you run your report and confirm the parameters are correct, what format should be utilized for your export?

Exported Data

Most ERP systems allow the exporting of data in the following four formats:

- PDF (portable document format)

- Excel

- CSV (comma-separated values)

- Text file

One major drawback in an Excel, CSV, and text file is that, by their nature, they are editable upon export. An additional drawback of a text file is that it does not contain formatting. As the volume of data grows, proving out the completeness and accuracy becomes more challenging. For these reasons, a PDF export is typically preferred.

After the data is exported in one of the four formats, you want to ensure that it agrees back to the system (completeness and accuracy). Here are a few ways to do that:

- Does the exported data have dollar amount totals? If so, agree the total dollar amount to the system.

- Does the exported data have hash totals? An example of a hash total is employee ID numbers which in aggregate have no real value other than providing confirmation that the data is complete and accurate.

- Does the report have a total line count? If totals are not available, line counts may be used. However, it is important to note that while the line count may agree, the data itself could have still been inadvertently manipulated.

Screenshots of Data

Retaining screenshots is imperative for documentation. A detailed screenshot should include some (if not all) of the following:

- Totals (dollar amounts, hash amounts, etc.)

- Lines count

- Parameters utilized

- Time and date stamp

The first three items validate the completeness and accuracy of the exported data. The fourth item confirms when the report was run and if it was timely. There are many reports that are point-in-time and may not be recreated at a future date. Knowing the constraints of the reports you use is important. Retaining screenshots cannot be overemphasized, especially for point-in-time reports.

Certain ERP systems or online portals do not provide a preview of the report prior to the export. This puts a constraint on the validation of completeness and accuracy, as it inhibits screenshots from being taken. In this case, as part of the review, the reviewer should re-run the report and validate that the original report used matches the information in the re-run report.

Strengthen Your SOX Compliance by Implementing Best Practices

There is no perfect science to IPE documentation. But the end goal is to be as detailed as possible. By simply focusing on the fundamental questions and ensuring that your documentation addresses them, your documentation will inevitably improve.

Developing best practices for your team is the cornerstone for any successful audit. Ensure you have the right guidance to make it happen. Our Audit and Assurance team can tailor a SOX environment to meet your needs. Contact us today to learn more.