3 Steps Your Government Can Take to Establish Greater ESG Oversight

Executive Summary

- As ESG issues gain prominence, state and local governments must increase oversight, planning, collaboration, and transparency around these topics to maintain public trust and access financing.

- Governments should develop, maintain, and regularly update public climate action plans outlining ESG risks, opportunities, impacts, and integration strategies.

- Entities should explore green bonds as a growing option to raise ESG-tied funding while increasing related financial disclosures to satisfy investor expectations.

~

Environmental, social, and governance (ESG) issues are taking center stage globally, and U.S. state and local governments — especially those issuing municipal bonds — are facing rising expectations from constituents and investors alike to manage these concerns. To maintain public trust and access to financing, your government should make ESG an increased area of focus, discussion, and disclosure.

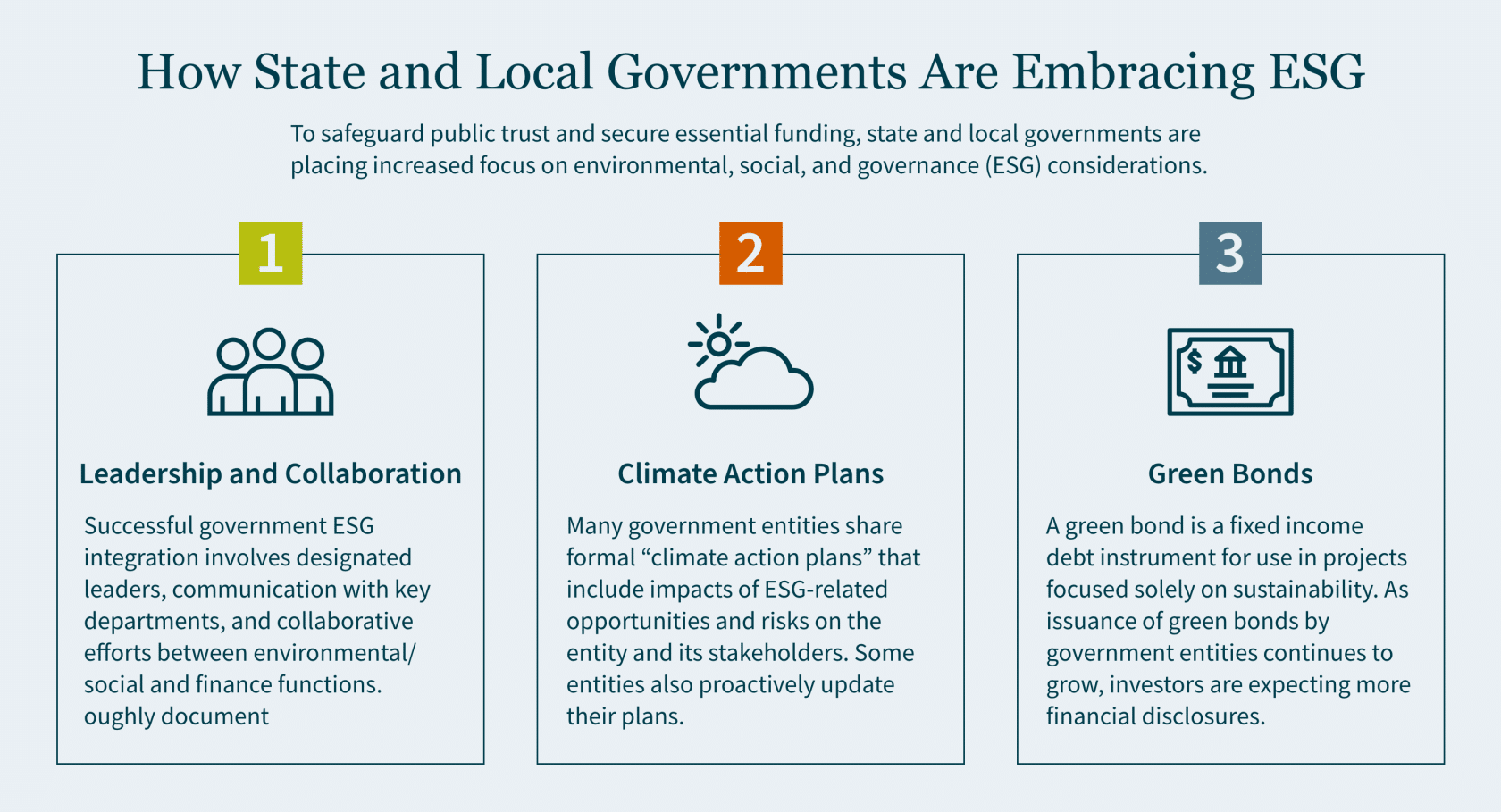

Here are a trio of ways your government can bring ESG efforts to the forefront:

1. Prioritize Leadership and Collaboration

The most successful government entities not only have designated ESG leaders (typically the “chief sustainability officer” or “head of environmental affairs”), but they have also established a direct line of oversight and communication with the government entity’s leadership teams (e.g., the mayor’s office, the office of the comptroller, etc.).

While ESG strategy and risk identification will always be owned by the head of the environmental and social functions, collaboration with the finance functions is also vital. Collaboration ensures that financial professionals can contribute their knowledge and experience to assess the financial impact of ESG initiatives and align them with broader strategies of the government.

Collaboratively embedding ESG efforts throughout your entity and not just siloing them to one specific department or group of individuals will give ESG the attention and investment it needs to make an impact.

2. Develop and Maintain a Climate Action Plan

At present, most medium-to-large government entities have formally documented “climate action plans” available on their websites — indicating this type of transparency will be considered “table stakes” moving forward.

Within the climate action plan, a clear strategy to identify and prioritize risks and opportunities is critical. A robust plan should specifically measure both the actual and potential impacts of ESG-related opportunities and risks on the government entity (such as on its financial planning and budgeting) and its stakeholders (e.g., investors and the communities the entity serves). Establishing and publicly communicating these on the entity’s website — or attached in the climate action plan — is key for accountability and understanding of these aspects of sustainability integration.

Additionally, a subset of government entities with climate action plans are also proactively updating their plans — effectively recognizing the plan should be a living and breathing document that continues to evolve with the emergence of new risks and the shifting interest of investors, regulators, and the public at large.

3. Explore the Potential of Green Bonds

Due to the increasing importance of sustainability and ESG for state and local governments, the issuance of green bonds by government entities will also continue to grow. Investors are expecting more financial disclosures to help them make decisions and track both opportunity and risk.

A green bond is a fixed income debt instrument occurring when an issuer (in this case, a state or local government) borrows a large amount of money from investors to use in projects focused solely on sustainability. They are similar in function to traditional bonds, except the funds acquired through them can only be dedicated to projects dedicated to energy efficiency or sustainability requirements and frameworks.

Because investors face risk when it comes to investing in municipal securities (like green bonds), it is crucial for these municipalities to have dedicated ESG leaders, offices, and transparent budgets.

Embracing ESG Principles and Building Positive Public Perception

With intensifying investor and community demands, state and local governments can no longer view ESG as an afterthought. Implementing robust oversight frameworks with designated leadership, continually updated climate action plans, and increased financial disclosures can help you meet expectations, mitigate risks, and contribute to long-term fiscal sustainability.

Need assistance implementing and managing your government’s ESG efforts? Our State and Local Government Practice offers ESG materiality and benchmark assessment, reporting and disclosure, data lineage and integrity, and net zero strategy development and monitoring. Reach out to our team today to learn how we can help you achieve your goals.