Uncorking Complexity: Navigating Tax Challenges in the Winery and Vineyard Industry

The world of wineries and vineyards is a harmonious blend of tradition, innovation, and meticulous craftmanship. As California grapes transform into wines that delight consumers across the globe, another transformation process is unfolding behind the scenes: one that involves intricate tax considerations like transition planning, international exporting, and proactive tax planning strategies.

In this overview, our International Tax and Private Client Services teams “uncork” the complexities of tax issues that permeate the winery and vineyard industry so you can seamlessly confront tax challenges and seize tax opportunities. As financial landscapes continue to evolve, understanding these challenges becomes essential for vineyard owners, winemakers, and investors alike in their pursuit of crafting both exquisite wines and sustainable financial success. And as some new seasons start, others come to an end. When the time comes to transition the business, you will likely want a seasoned professional to guide you through.

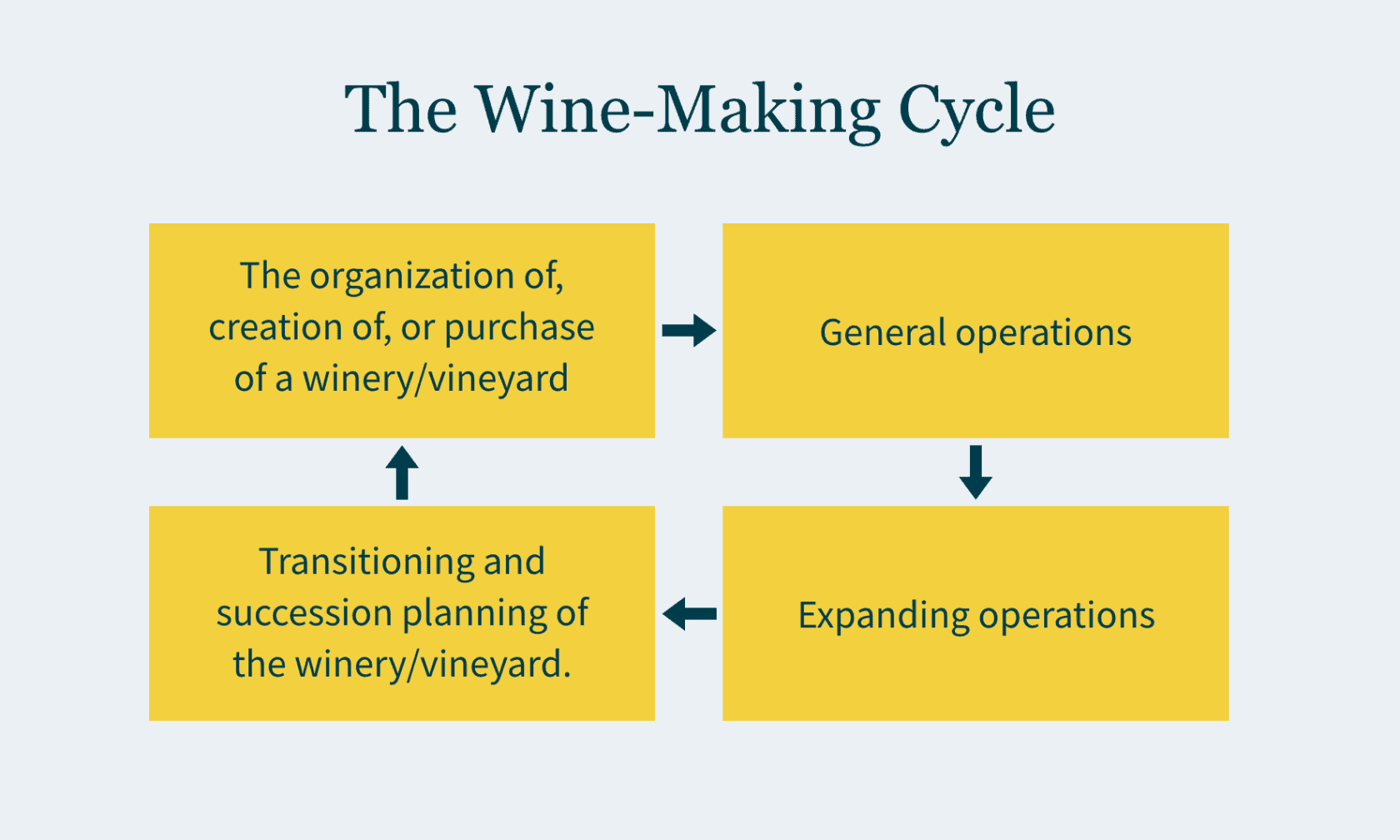

The wine-making cycle

Generally, a vineyard or winery has a business cycle that may take various courses but the course we see most commonly goes as follows:

Organization / Creation / Purchase

The creation of the organization generally entails the creation of an appropriate legal entity. Whether this act should be taxable or not will depend on the tax attributes of the potential owners and should be reviewed to position the organization optimally for taxing purposes.

The purchase of an existing winery or vineyard should be structured in a tax efficient manner such that future depreciation and deductions are maximized for the purchaser. Typically, the maximization of deductions will be at odds with what a seller would desire, so the final decision will stem from negotiations between both the buyer(s) and seller(s). Ultimately, a good due diligence exercise is always warranted in these situations.

Operations

Both metaphorically and physically, the seasons always present themselves with a new beginning for the industry.

There are many ways to operate a winery or vineyard. You may start with raw land—and then have vines, or not. Rocky soil and warm temperatures provide an excellent environment for grapes to make Cabernet Sauvignon, for example. Cooler microclimates and sandier soil offer great growing conditions for Sauvignon Blanc. A vineyard manager may want to “test” some of the grounds and only plant a smaller portion of the plot.

When planting a new crop, it can sometimes take up to three years before a vine produces viable grapes. Veraison is that magical moment when those hard, green grapes transform into plump, juicy clusters. In white grapes, such as those used for Sauvignon Blanc and Chardonnay, the clusters turn from bright green to a more mellow, golden green.

Once your grapes are ready, one may harvest and then crush, press, and start the primary fermentation process. Then the aging and malolactic fermentation sets in. Towards the end of the aging process, winemakers will frequently taste the wine to ensure the flavors are just right. They do this with a “wine thief,” or a special tool that extracts a small amount of wine from the container it is aging in. This is commonly referred to as racking and bottling. Once the process is complete, then one obtains the finished bottle.

Having an appropriate cost accounting system is crucial to tracking the costs that are attributed to each step in the process — and will be the cornerstone to any tax planning you will want to implement.

Having an appropriate cost accounting system should help track the costs that are attributed at each step of the way.

Some of the tax implications that should be considered are provided below.

Qualifying for R&D tax credits

Archaeological records insinuate that wine was first produced in China around 7000 B.C., with the oldest winery in the world in Armenia. So, it’s no secret that wine making has been around for a long time. However, this doesn’t mean winery owners can’t and don’t implement new technologies or approaches to making their cultivation and fermentation methods more innovatively efficient.

And many in the industry do not claim the Research and Development (R&D) tax credit, failing to realize their research activities actually fall into the qualifying research activity (QRA) category. In fact, many daily activities you may already conduct — as well as wages paid to your employees involved in these activities — can qualify.

R&D tax credits enable your business to apply for a dollar-for-dollar reduction of your tax applied to any qualified research and development expenditures you may have. In some circumstances, these credits can be applied against payroll taxes as well. These can provide significant value to your organization, as it provides reduced tax liability and cash back so you can reinvest or apply to other needs. Companies of all sizes are eligible — and the tax definition of “qualified research” is broader than you might think, covering more than research that takes place in a lab. If you develop new or improved products, processes, and/or software to use in your operations, you could be eligible for technologically advancing the industry.

Whether it’s making unique improvements to products already available on the market or inventing something completely new, if you demonstrate you’ve experimented to resolve technological uncertainties and tackle challenges that are new to you, you could qualify. This includes new or improved beverages. The best part? You don’t have to actually achieve your goals in order to qualify.

Examples of qualifying activities

- Improving or creating bottling and packaging processes.

- This includes bottle labeling or equipment, corks, and methods to improve filtration and shelf life. This could include new packaging designs to improve shelf life.

- Optimizing vineyard plots.

- This can mean evaluating soil, water availability, and ground slopes for optimal grape cultivation; soil and rootstock process improvement; plant irrigation system development; and trellis improvements.

- Augmenting your production mix.

- This can include evaluating conditions that affect winemaking like humidity, lighting, and ventilation in your barrels; developing product formulations; experimenting with new combinations for unique flavors; creating new aroma/flavor profiles and ingredient mixing methodologies; experimenting with prototype batches and preservative chemicals; developing new fermenting techniques; developing or refining press-fraction, press-yield or other crush or press trials; etc.

- Recycling efforts and techniques related to waste management along with sustainable energy technologies.

Commonly missed fixed asset tax savings opportunities

Fixed assets — i.e., property, plant, and equipment involved in your winemaking — can prove a powerful tax savings tool if you manage them correctly as well as increase your cash flow, so you can reinvest the savings or hold onto them to endure an uneven or less fruitful year.

Some of the tax opportunities you can capitalize on in the wine industry include:

- Reducing your current-year tax liabilities,

- Increasing your current-year cash flow, and

- Deferring your tax liabilities to later years.

Depreciated assets are one area you might overlook. Because wine production requires a significant amount of equipment you might not think about initially (like infrastructure and process-related electrical and plumbing hookups in your facility), you can count them in the total share of your property’s acquisition or constructed cost. The higher the percentage in assets available for shorter recovery periods, the more tax deferral opportunities you may have. Careful categorizing of assets between personal property v. real property can mean a substantial difference in tax benefit including amount and timing in a given year.

If you have implemented ways to make your winery more environmentally friendly, you may also capitalize on energy efficiency incentives. With an intensifying focus on environmental, social, and governance (ESG) permeating more industries, you can take advantage of available credits and deductions, which are measured against your facility’s ability to utilize alternative power systems (like solar energy) or the installation of energy efficient heating, ventilation, air condition, and lighting.

American viticulture areas

When you first purchase a vineyard, you have the option of acquiring an American Viticulture Area (AVA) intangible asset, whose value is recovered over 15 years through amortization. This provides annual deductions that lower your taxable income — a beneficial opportunity as it shifts the value out of the land that is normally not able to be depreciated.

Didn’t measure an AVA intangible when you bought your vineyard? That’s okay. An AVCA valuation can be performed — and any missed amortization deductions will be taken out from your application year.

Once the domestic tax planning is well oiled, some wineries and vineyards decide to expand.

Expanding operations

Many owners tend to expand their domestic operations, or some even venture overseas. Going offshore presents its own diverse challenges, some of which are described below.

International tax challenges

Exporting your wine abroad is a huge step — and one that can yield significant brand recognition and financial gain. Navigating the challenges associated with crossing borders and marketing in foreign markets coupled with international tax can prove extremely complex for wineries and vineyards because tax regulations vary from country to country, significantly impacting your operations and profitability. The taxes one may need to contend will be beverage taxes, customs and duties, tariffs and income tax, to name a few.

First and foremost, it’s critical that you work directly with experienced tax professionals who are knowledgeable not only about the area where your vineyard is located but also about the laws in the countries where you are exporting to. They can help you remain compliant amid the many seemingly convoluted challenges you face.

Because many countries have double taxation agreements (DTAs) to prevent the same income from being taxed twice, you should understand how these work between your home country and the countries you do business in. You certainly don’t want to be taxed twice!

Another way to successfully traverse these challenges is ensuring your transfer pricing practices are aligned with international guidelines. You’ll want your pricing transactions to remain fair between related entities to avoid tax evasion or an excessive tax burden in specific jurisdictions.

In general, it’s important to ensure you’re well versed in the tax laws of the countries you’re exporting to or operating in. That’s why a tax professional can come in handy. Different countries have different rules about importing, excise taxes, value-added taxes (VAT), and other forms of taxation that can majorly affect your business if you’re not complying.

This brings us to compliance with your reporting. Reporting all your international transactions and income is critical to avoiding penalties or legal issues. You’ll also need to consider any customs duties and tariffs, which may impact how successfully your wine competes in international markets. International tax regulations can change frequently at the hands of political, legal, or economic factors. Stay up to date on changes that could impact your business operations—or tax liabilities.

And just like the U.S. provides tax incentives, some countries do as well to encourage foreign investment and exportation. Your winery or vineyard could take advantage of these if they are available.

International tax compliance when exporting your wine can be complex. It also involves risk. Because every situation is different, you must tailor your approach based on the specific circumstances of your winery with advice from a professional knowledgeable in international tax. They can ensure you are adhering to the most updated regulations as well as maximizing your tax efficiency while remaining compliant.

From simply exporting abroad to setting up local in-country distribution operations we may assist by tailoring a strategy that best meshes with your company. A strategy many exporters use is an IC-DISC. The IC-DISC (Interest Charge-Domestic International Sales Corporation) is a federal income tax incentive for U.S. companies that may export their California wines outside of the United States. Domestic U.S. entities and sole proprietorships are eligible to receive this federal income tax savings. Our team may guide you as to whether an IC-DISC or other strategies are more suitable for you and your winery or vineyard.

Transition and succession planning

Whether you’re passing the business to the next generation or selling to a new owner, transition planning is crucial for taxes in the winery business, as it helps to ensure a smooth and successful transfer of ownership and management. However, transitioning a winery business involves complex financial transactions like asset transfers and potential restructuring. Tax efficiency is key to minimizing potential tax liabilities that could arise from poorly executed transfers. Here are some things to consider.

Minimizing your capital gains tax

Depending on if your winery has appreciated in value since its inception, transferring ownership can trigger capital gains tax. Strategizing the timing and structure of the transfer can potentially minimize these taxes through options like installment sales, gifting, or estate planning techniques. In fact, if the winery has been owned by a corporation, you might be able to sell your stock in that corporation with no taxable gains at all and/or rollover the gain into a new business, income tax free.

Navigating estate and gift tax considerations

Many wineries or vineyards are family affairs. If this is the case, you might face estate and gift tax implications. Taking advantage of exemptions and deductions can help you reduce the impact of estate and gift taxes.

Creating a smooth succession plan

Whether or not you’ve seen the popular show Succession, you know that sometimes, passing something as large as a corporation down to the next generation can cause some drama. That’s why succession planning is critical — it smooths the handover of management and ownership, which will help maintain your business’s stability and profitability. This can include a phased transition, training and development of successors, and establishing clear roles and responsibilities.

Optimizing your business structure

Different business structures have different tax implications. Knowing how to take advantage of your current structure’s tax efficiency and being open to changing it if that could prove advantageous before a transition occurs can pay dividends.

Assessing your value

Knowing the accurate value of your winery business is essential for tax purposes to calculate estate taxes or establish a fair selling price. Conducting a professional appraisal can ensure your business’s value is appropriately assessed.

Determining if you qualify for tax breaks

Some areas offer tax incentives for qualified business transfers, including reduced rates for capital gains taxes or other tax breaks. If you conduct transition planning, you can understand and leverage these applicable incentives.

Complying with tax laws and regulations.

Because tax laws and regulations can vary widely depending on where your winery or vineyard is located — not to mention they change over time — transition planning helps you stay aware of relevant tax regulations over the course of the transfer process, so you don’t incur penalties or legal issues.

Transition planning is a strategic process that analyzes the various tax implications that could affect a seamless and financially sound transition of ownership and management in your business. Tax professionals with experience in the wine industry can help you develop a transition plan tailored to your exact circumstances.

How we can help

Making and selling great wine is your top priority — which is why we’re here to help you navigate the tax challenges and seize the opportunities that can accompany following that passion. Our Private Client Services and International Tax teams are rooted in California, one of the most wine-centric regions in the world. We understand the nuances of your work while providing an external, holistic eye to help you grow and succeed. Contact us today.