Reverse Sales Tax Audits: Potential Tax Savings for Cannabis Operators

Executive Summary:

- Sales and use tax requirements and exemptions vary from jurisdiction to jurisdiction but purchases for cultivation and manufacturing activities are often fully or partially exempt – even for cannabis taxpayers.

- A reverse sales and use tax audit is a proactive measure to help your organization identify overpaid sales and used taxes, recover overpayments, and devise strategies to reduce future sales and use tax burdens.

For organizations operating in the cannabis industry, complying with applicable state and local tax authorities is critical to maintaining the business because they are often the same agencies that issue operating licenses. As a result, cannabis operators may find themselves “over-complying” with sales tax rules and neglecting potential savings when it comes to purchase exemptions. Specifically, many states provide agricultural and manufacturing exemptions from sales and use taxes, which you can take advantage of by presenting the appropriate sales tax exemption certificate form to your vendors. And for taxes that have already been paid (and that are still within the statute of limitations), you can submit a claim for refund – through a process that is often referred to as a “reverse audit.”

While the term "audit" might have a negative connotation for business owners, a reverse audit can uncover potential savings. Let's explore how our State and Local Tax team leverage agricultural and manufacturing exemptions and perform a reverse audit to improve your bottom line.

What are agricultural and manufacturing exemptions to sales and use tax?

Exemptions from sales and use tax may be based on the following:

- The type of property being sold,

- The identity of the purchaser (such as a non-profit organization or the federal government), or

- How the property will be used.

The last category includes agricultural and manufacturing exemptions. These protections are based on the premise that the purchase of certain goods and services used directly in the production process should not be subject to sales and use tax.

States offer these exemptions for any number of reasons: to stimulate growth in these sectors, encourage manufacturers to begin or continue manufacturing operations in their jurisdictions, or keep food prices low for consumers.

The types of transactions exempt from sales and use tax vary by state but generally include:

- Supplies and raw materials. Most states exempt raw materials used in manufacturing or agriculture from sales and use taxes as long as the materials are incorporated into or become an ingredient or component part of the manufactured product. Many states also provide sales and use tax breaks for feed used for livestock and seeds, roots, bulbs, small plants and fertilizer planted or applied to land.

- Machinery and equipment. Many states exempt machinery or equipment used exclusively for agricultural or manufacturing operations from sales and use taxes. However, limitations on these exemptions are common and vary by state. For example, in California, farm equipment and machinery purchases are only partially exempt from sales tax if the equipment is used exclusively or primarily (50% or more of the time) in producing and harvesting agricultural products.

- Fuel and utilities. More than half of states don't levy sales tax on fuel or utilities used in manufacturing and agriculture, although some states have specific requirements. For example, a state may allow taxpayers to exempt the cost of electricity used in manufacturing if it exceeds 5% of the cost of production.

- Packaging materials. Most states do not tax sales of packaging materials for manufactured goods and containers and other items used to package and transport agricultural products. However, some states limit this exemption to nonreturnable packaging, and others limit exceptions to certain types of packaging or packaging materials for specific types of agricultural products.

- Pollution control equipment. Many states offer tax breaks for pollution control equipment used to control air or water pollution.

- Sales to resellers. All states provide a resale exemption, which exempts sales to retailers or distributors who will resell taxable goods to consumers or other distributors.

These exemptions vary by jurisdiction and are subject to frequent changes, whether from legislative changes or evolving Department of Revenue interpretations. In addition, while a handful of states provide guidance on sales and use tax exemptions for cannabis cultivation, other states have not explicitly addressed whether certain aspects of cannabis cultivation qualify for these exemptions. This makes compliance — and taking advantage of all available exempt transactions — challenging for businesses in the cannabis industry.

What is a reverse sales tax audit?

A reverse sales and use tax audit is a specialized financial examination conducted by a state and local tax professional to identify overpaid taxes and comply with state and local tax laws. Unlike many other types of audits, the goal of a reverse audit isn't to uncover underpayment of tax liability and levy penalties.

Instead, conducting a reverse audit is designed to uncover overpayments stemming from inaccuracies in tax calculations or overlooking applicable exemptions, including those for agricultural and manufacturing purchases and sales, and then submit claims for refund or credit towards future tax liabilities.

The goal of a reverse audit is not just to identify and recover these overpayments but also to implement strategies to reduce the burden of remitting sales tax in the future. It's a proactive measure that companies can take to improve their bottom line, ensuring they only pay what is legally due and take full advantage of available tax exemptions.

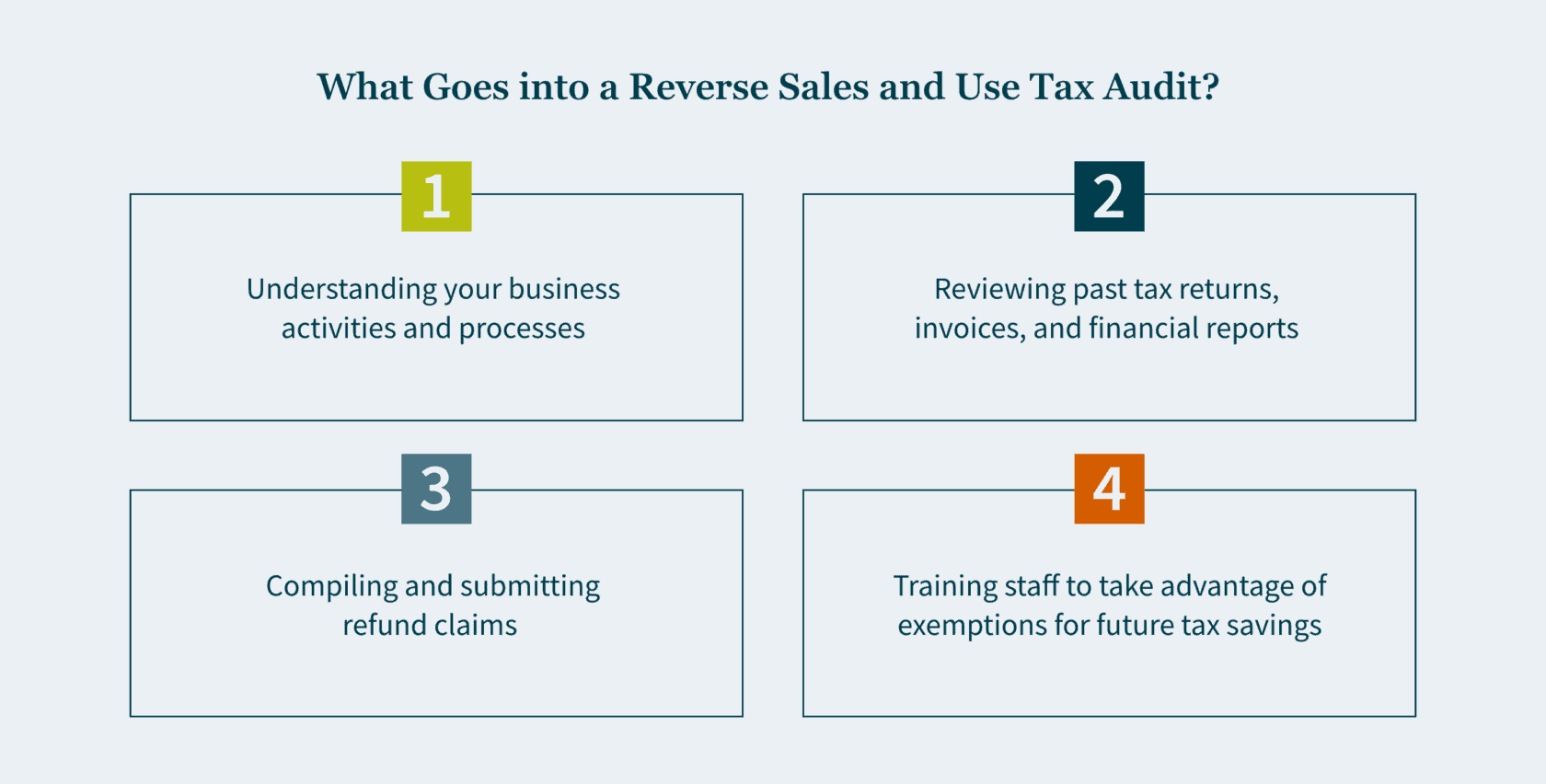

What does a reverse sales and use audit entail?

The exact process for conducting a reverse sales and use tax audit depends on your unique business needs and attributes. However, it generally requires:

- An initial scoping phase to get a sense for how large of a potential claim might exist. This involves gaining an understanding of your business activities and purchasing processes, identifying the location of those activities and the corresponding assets, and sampling your invoices to see how you were charged tax by vendors.

- Claim development stage, if it is determined that a material claim is feasible. This entails a detailed review of past tax forms, tax returns, invoices, accruals, and additional information, aimed to uncover instances where the business likely overpaid its sales tax liability. This information must be compiled and workpapers created, not only to calculate the amount of claim but to prove it at a later stage.

- Claim submission to the relevant tax authority (-ies) must be completed prior to the end of the open statute of limitations period for the oldest claim refund in the package. Each state will have specific procedures and forms for how the claim must be submitted, and frequently an audit of the claim periods will commence either before or after the claim payment.

- Finally, it is best practice to avoid being charged the tax in the first place. So it makes sense to train you staff on how to determine when the company has potentially exempt purchases and what is needed to ensure vendors do not assess the tax.

The lookback period for a reverse sales and use tax audit will vary because the statute of limitations varies from state to state. Many states allow taxpayers to claim refunds of overpaid sales and use taxes for three years, while others have a four-year lookback period. Additionally, the lookback period may be extended if your company is currently undergoing a sales tax audit by a state or local tax authority.

How we can help

Performing a reverse audit can be a powerful tax savings tool for any business with agricultural or manufacturing activities – but especially cannabis operators. Accessing potential tax overpayments can bolster cash flow and fixing the underlying system will improve your bottom line. If you'd like to learn more about whether a reverse state sales tax audit might benefit your organization, call or contact MGO online today. We're happy to discuss your taxable purchases, potential exemptions, and the overall reverse audit process to see if the potential for money back in your pocket outweighs the time and effort required.