New Jersey Residents Telecommuting for New York Employers Eligible for Income Tax Credits

Executive Summary:

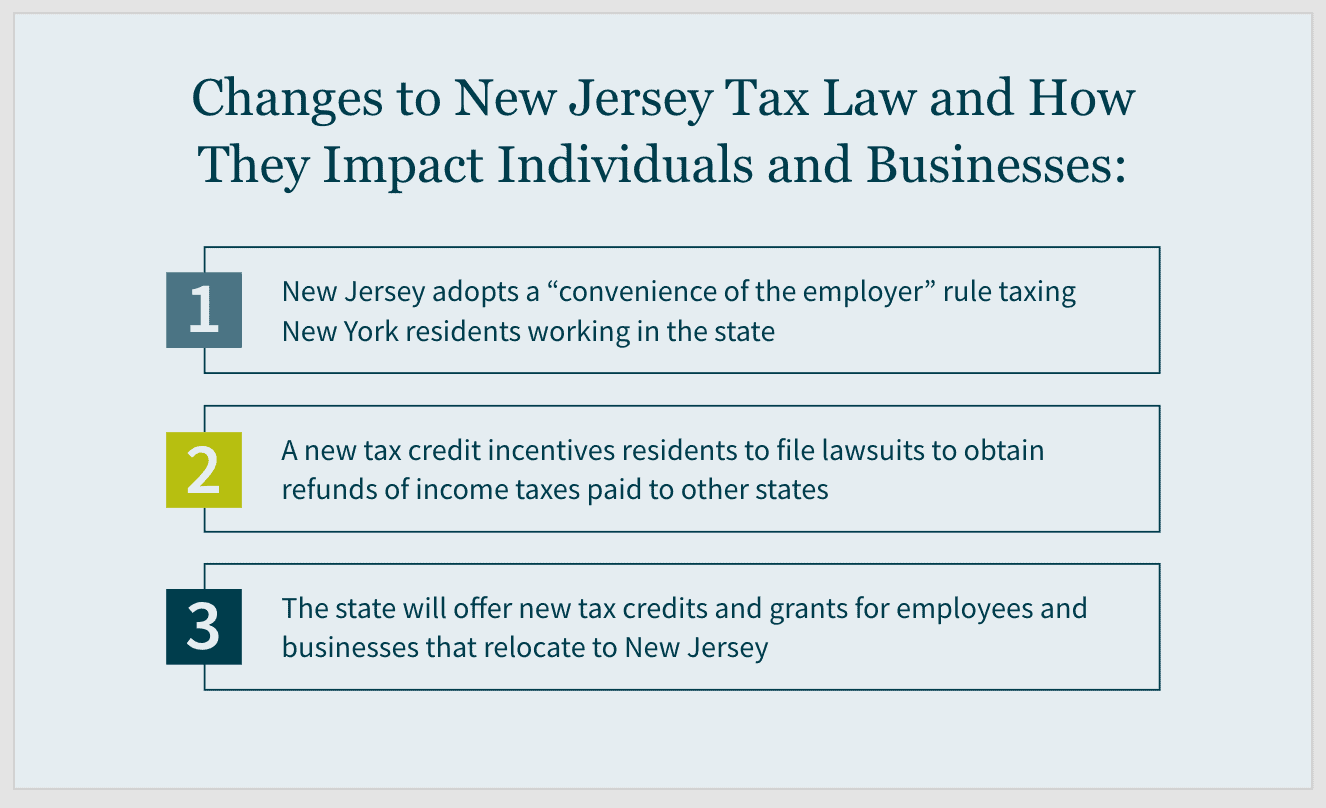

- New Jersey has adopted its own "convenience of the employer" rule taxing nonresidents of New Jersey who work remotely for convenience, which will particularly impact residents of New York working in New Jersey.

- The state also introduced incentives for residents to file lawsuits and appeals seeking to obtain income tax refunds from New York and for employers who relocate employees to New Jersey.

- Telecommuting employees working for New Jersey employers may need to adjust their payroll withholdings or make estimated tax payments for 2023 to avoid underpayment penalties.

~

A bill recently passed by the New Jersey state legislature changes how the state views income earned by some residents who work for out-of-state employers — and is bound to irritate lawmakers in neighboring New York.

Until now, New Jersey law stated income should be taxed by the state where it was earned — even if the employee works remotely. For example, a New Jersey resident who telecommutes to a job in New York City pays taxes in New York. New Jersey offered a tax credit, so workers weren't subject to double taxation. Now, New Jersey is looking to recoup some of the tax revenues it pays out in credits and will do so at the expense of New York residents working for New Jersey-based companies.

Understanding New York's "convenience of the employer" rule

To understand the change to New Jersey’s tax legislation, it’s essential to understand how New York’s convenience of the employer rule.

New York imposes a personal income tax on any nonresident's taxable income derived from New York sources. For nonresident employees performing services both in and outside of New York, New York-source income is based on the proportion of data worked in New York versus days worked everywhere else.

However, New York's "convenience of the employer" (COE) rule provides an exception to the general rule of allocation based on physical location. The law states "any allowance for days worked outside New York State must be based upon the performance of service which, because of necessity (not convenience) of the employer, obligate the employee to out-of-state duties in the service of [the] employer."

While this rule has been in place for years, it faced increased scrutiny during the COVID-19 pandemic when the State of New York closed non-essential businesses, and many employees started working from home — often outside the state.

Many workers (and their tax advisors) assumed these employees worked remotely out of necessity rather than convenience, rendering the convenience rule inapplicable. However, in October 2020, the New York State Department of Taxation and Finance updated its FAQs for telecommuters, clarifying that "if you are a nonresident whose primary office is in New York State, your days telecommuting during the pandemic are considered days worked in the state unless your employer has established a bona fide employer office at your telecommuting location."

Several factors go into determining whether a home office constitutes a bona fide employer office; TSB-M-06(5)I outlines the employer test. However, very few work-from-home arrangements qualified as a bona fide employer office, meaning most taxpayers assigned to work in New York but working from home outside the state must still pay New York income taxes as if they were commuting to a workplace in New York.

While employees in New Jersey could escape double taxation by claiming a tax credit on their New Jersey state income tax return for taxes paid to New York, it often still resulted in the employee paying taxes at a higher rate.

New Jersey laws seek to bring businesses (and tax dollars) home

According to Bloomberg Tax, New Jersey paid out personal income tax credits of $2.9 billion in 2021 and $2.3 billion in 2022, although the state's Department of Tax Treasury data does not break down the split between commuters and remote workers.

Tired of footing the bill for New York's policy, New Jersey Governor Phil Murphy recently signed legislation that will impact nonresidents working for New Jersey employers and New Jersey residents working in other states.

NJ adopts its own convenience of the employer rule

First, New Jersey Assembly Bill 4694 retroactively establishes a convenience of the employer provision, effective January 1, 2023.

New Jersey's COE rule essentially mirrors New York's rule by taxing nonresidents of New Jersey who work remotely outside of the state for their convenience IF the employees are residents of another state that imposes a similar COE rule (i.e., New York). States that impose a COE rule but have a reciprocal agreement with New Jersey, such as Pennsylvania, would be excluded.

New tax credit for NJ resident taxpayers

New Jersey also created a new refundable tax credit for residents who obtain a final judgment in their favor from another state's tax court or tribunal. This credit essentially incentives New Jersey residents to file lawsuits and appeals in New York (and other applicable states) to obtain refunds of taxes paid to those states.

Taxpayers who successfully earn a refund from New York are eligible for a bonus credit equal to 50% of what they owe to New Jersey due to the readjustments for tax years 2020 through 2023.

Incentives for employers relocating to NJ

The new legislation also incentives employers to relocate to The Garden State.

First, it provides a $2,000 credit to individual taxpayers who seek to be reassigned from an out-of-state location to a New Jersey location, with $10 million per tax year available for such credits.

In addition, grants are available to businesses with 25 or more full-time employees and a principal place of business outside the state when they assign resident employees to New Jersey locations. The grant is worth up to $500,000 per business and up to $35 million per year in the aggregate.

What this means for employees and employers

Telecommuting employees working for New Jersey employers may need to adjust their payroll withholdings or make estimated tax payments for tax year 2023. This applies to workers in any state with a convenience of the employer rule, including New York, Connecticut, Delaware, and Nebraska. Pennsylvania resident employees working in New Jersey will not need to adjust how they withhold income tax because the states have a reciprocal agreement.

Employees should contact their employer's payroll or human resources department to update their withholdings.

Because the new law didn't go into effect until after halfway through the year, New Jersey's Division of Taxation issued guidance that it would not impose interest or penalties on under-withheld taxpayers or employers as long as they began complying with the new law as of September 15, 2023.

New Jersey businesses may also want to review their employee work locations and remote work policies in light of the new state personal income tax withholding requirement.

How we can help

The changes in how New Jersey deals with taxing telecommuters have significant implications for businesses and individuals. To fully understand the effects of convenience of employer tax regulations, schedule a conversation with an MGO advisor. With the proper guidance and direction, we can help you determine the best way to move forward.