Welcome to the Cannabis M&A Field Guide from MGO. In this series, our practice leaders and service providers provide guidance for navigating M&A deals in this new phase of the quickly expanding industries of cannabis, hemp, and related products and services. Reporting from the front-lines, our team members are structuring deals, implementing best practices, and magnifying synergies to protect investments and accrete value during post-deal integration. Our guidance on market realities takes into consideration sound accounting principles and financial responsibility to help operators and investors navigate the M&A process, facilitate successful transactions, and maximize value.

When planning to sell your cannabis or hemp operation, a core value driver is your willingness and execution in preparing for the transaction. Early preparation will motivate you and your team to undertake improvement activities that will appeal to potential Acquirers and ease the M&A process. There are numerous benefits to this preparation stage, with a little elbow grease and strategic planning you can: maximize the value of your organization during the valuation process; optimize the due diligence reviews, saving both time and money; and finally, convey to the Acquirer that you have firm control over your organization, instilling confidence and comfort.

Additionally, all the improvements we recommend improve efficiency and performance enterprise-wide, and provide additional controls and documentation to support on-going regulatory compliance – all essential to thriving in the competitive cannabis and hemp landscape.

It’s never too early to begin preparations

All too often, a Target company’s leadership team decides it is time to sell, begins networking and marketing, and only after the pieces are in motion, or potential acquirers are kicking the tires, the improvement processes begin. The next stages – valuation, preparing a data room, due diligence, etc. – are often a rush. Improvements to operations come too late and don’t positively impact the valuation. When hurried, mistakes can be made preparing appropriate documentation of finances, controls, and regulatory compliance, and the valuation and due diligence processes are delayed. Meanwhile, the market is moving and the growth curve may have changed or flattened out. Ultimately, valuations are suppressed or, in the worst case, Acquirers move on.

Considering the volatility of the cannabis and hemp landscapes, this is a reality that must be faced. Rather than wait until the market timing feels right, Target company leadership need to be planning well ahead of time. We recommend AT LEAST a 90 day window of preparation for an M&A transaction. Depending on the complexity of the operation, even more time may be needed. The good news is that by preparing ahead of time, the Target company gains the upper hand in most negotiations. You can wait to go to market when the timing is perfect, and then when you introduce your company or assets, you have extra confidence knowing everything is in order and you're putting your best face forward.

Audit preparedness is the name of the game

A common issue plaguing cannabis and hemp operations is inadequate documentation of finances, operations, and controls. Many operations have been founded by expert growers, scientists or sales persons who are leaders in their respective fields, and who’ve bootstrapped themselves every step of the way to seizing their respective market share. In these circumstances, documentation is often limited to the bare minimum to maintain tax and regulatory compliance. While this may be enough to continue operating, in the case of an M&A, an Acquirer is likely to need much more.

Especially if the Acquirer is a publically-owned company or SPAC (special purpose acquisition company), which will have robust financial/accounting teams and will conduct thorough due diligence. They’ll need to have clear visibility into all of the core areas of your operation, and confidence that internal controls exist, are adequate, and properly documented.

Preparing for this level of due diligence ultimately amounts to audit preparation. This is a stage that public companies are all too familiar with, and consider routine, but private companies may find onerous and time-consuming if they haven’t undergone the process before.

Know thyself - approach to M&A preparedness

Once you understand that M&A preparation is roughly akin to audit preparation, you can begin the process. To outline what to look for, we will take the perspective of an auditor, and describe what they will be reviewing and looking for, and what you should be doing to meet their needs.

Operational Assessment: The first thing an auditor will do is examine your operating procedures and internal control environment. They will review all operations and seek to establish that you have appropriate financial personnel, processes, and controls in place.

In even the most high-functioning organizations, there are often opportunities to improve operational efficiency. Following are a couple questions to ask:

- Are you losing cash? Do you have adequate capital on hand? - In the cash-heavy, but capital-poor, cannabis marketplace, an Acquirer will closely examine your financials. If your internal control environment isn’t continually assessing margins to find opportunities to tighten things up, now is the time to do so. There are relatively simple actions that can be taken to improve your bottom line and make your operation more desirable to an Acquirer.

- What is the strength of your internal controls? Is documentation appropriate? - While the numbers visible reviewing financials are helpful to an Acquirer, the knowledge that internal controls are sufficient lends validity to those numbers. If you aren’t getting detailed financial information from your control environment, it is never too late to strengthen this area. Whether selling now or in the future, clear visibility, and checks and balances, will improve efficiency.

- Have you tested, and documented, cash and inventory controls? - An Acquirer (just like an auditor) is going to want to see verifiable, periodic integrity for both cash and inventory. Quarterly counts are the minimum for good accounting practices. If you’re not doing this yet, start now, the stronger your history the better. The process of reviewing cash and inventory controls will likely also produce opportunities for improvement. Inventory controls, for example, may uncover opportunities to write off obsolete or spoiled inventory, boosting your bottom line.

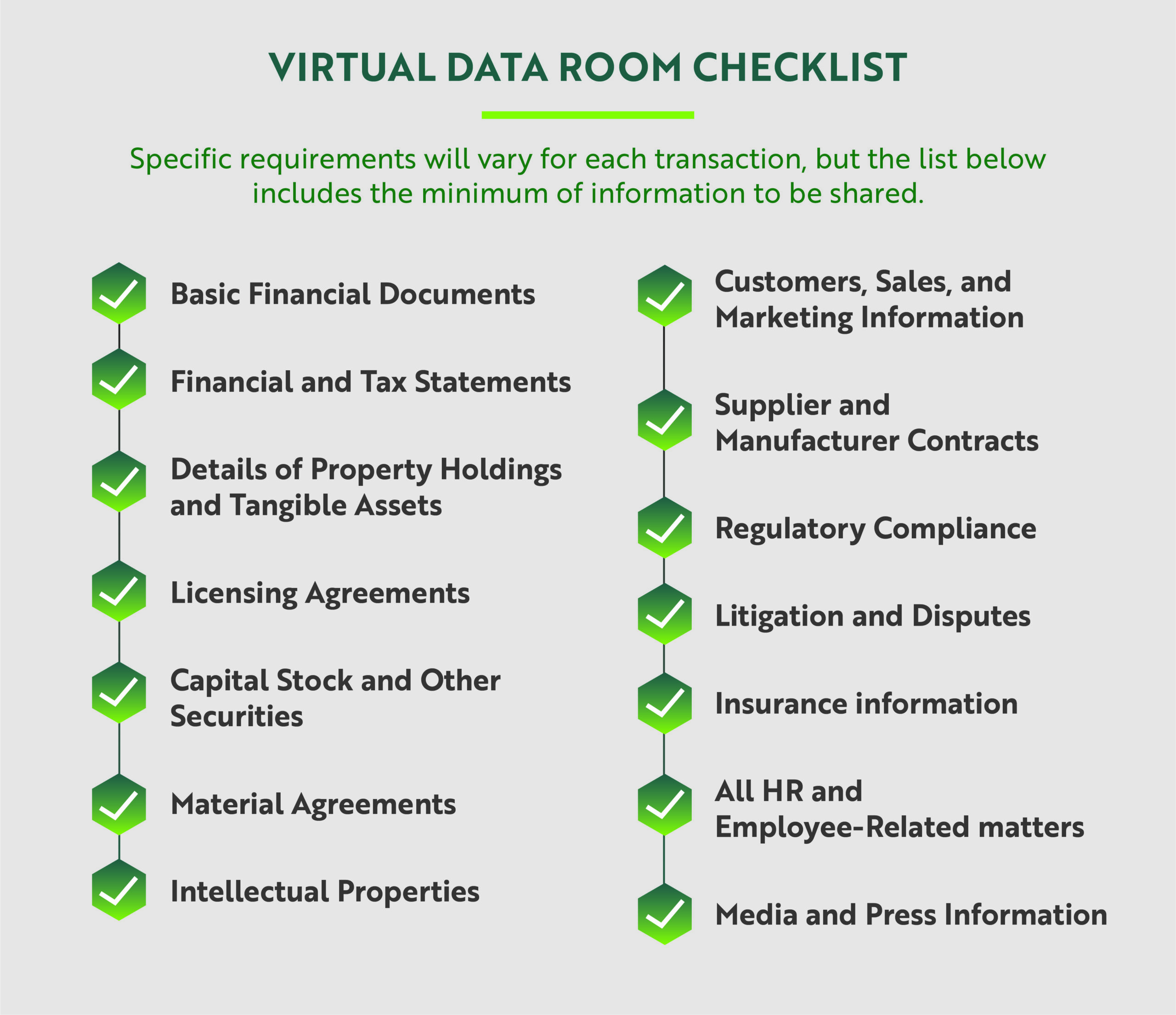

Getting your papers in order: During the due diligence process, the Acquirer and their team of lawyers, bankers and accountants, will want to see… well, just about everything. Cannabis and hemp companies often have incomplete information on existing contracts, stock options, cash logs, corporate records, etc. A buyer will insist on seeing all financial data, important contracts, and much more, and you must be prepared to build a data room and deliver that information quickly and efficiently.

If you’re unsure whether your books and financial data are adequate, here are some questions to ask:

- Have you reconciled all accounts? - Ahead of the M&A deal, you’ll need to ensure all of your accounts are as up-to-date as possible. This includes paying any bills and collecting any invoices. This will help make sure your financial information supports accurate projections and analysis.

- Are your books clean? - We don’t mean free of fraud (that goes without saying), but are your cash counts and logs up to date? Can you properly track all cash going in and out? Can you provide receipts for all purchases and sales? And finally, and most importantly, are you categorizing expenses appropriately? IRC 280E is a major point of concern for all cannabis M&A transactions, as the Acquirer will be prodding for any potential 280E tax exposure.

- Are your employees categorized correctly? - A common mistake for cannabis companies is related to employee categorization and compensation. Also tied directly to 280E, it is essential that your full-time and part-time employees are in the appropriate categories, you have documentation (time sheets) supporting their work, and all 1099s are in good order.

Showing your best in the Quality of Earnings report

A standard part of the M&A due diligence process will be the Quality of Earnings (QOE) report. If you, as the Target Company, don’t provide one, it is a near guarantee that the Acquirer will request one. It is our recommended best practice to take the lead and have an independent accounting firm provide a sell-side quality of earnings report.

You can think of this as a practice run for the due diligence process. The team you bring in will dig deep into your financial statements and other documentation to analyze the findings. If all is well, the QOE will validate your financials and projections, providing significant validation to the Acquirer. If the QOE comes up with red flags, it is better that you’ve uncovered those yourself and you can make whatever adjustments needed.

The QOE report will examine the impact of events and activities outside your business’ normalized performance and cash flow. These can include management decisions, accounting methods, business environment, etc. It will also assess the condition and value of both tangible and intangible assets. And finally, measure the strength of operations and controls on a comparable basis for industry, product type, etc.

Building a data room

The final preparation step will be establishing a data room as the M&A process proceeds from initial discussions, as both the Acquirer and the Target company will need to exchange information in order to assign value to the deal, assess interest, and conduct due diligence. The data room is an essential tool for ensuring easy, secure access for confidential information and financial transactions.

Typically set up by the Target company, the data room provides a space where the Acquirer and the Target company – and their teams of advisors, attorneys and accountants – can meet and access confidential financial and operational data, including contracts, employee information, disclosures and other sensitive information. It is our recommended best practice that the data room is established separately from the day-to-day work activities of the Target company, to both ease access and limit risk.

Even before the COVID-19 pandemic, digital data rooms were preferred to physical data rooms. But now in the post-COVID-19 world, this is essentially a requirement. Significant improvements in digital access and security technology allow Target companies to maintain complete control over confidential data while still providing access globally.

Your VDR can be set-up to allow access to all documents or subsets of documents, and only to pre-approved individuals. A primary benefit of VDRs is that Acquirers can have access to new or amended documents instantly, without visiting a physical location. Meanwhile, the Target company, and their advisors, can review who has been in the data room and the dates of entry.

It is important to keep in mind that technology solutions are useful in so far as the human judgement using and safeguarding access. That is why it is critical for the Target company to dedicate qualified personnel to uploading and maintaining documentation, and monitoring and controlling VDR access and related tasks.

Final thoughts

In an M&A deal, early preparation is essential for the Target company. Not only can you save time and money by easing the M&A process, but you also maximize your potential in a valuation. While the process can be onerous, extra benefits come in the form of improved operational processes and financial controls. You’ll gain a better understanding of your organization, while significantly improving its value.

Catch up on previous articles in this series and see what's coming next...