California Franchise Tax Board Announces One-Time Penalty Abatement Program for Individual Tax Returns

The California Franchise Tax Board (FTB) recently announced a one-time penalty abatement program for California resident and non-resident individual taxpayers.

Here's what you need to know to claim it:

- It’s a one-time abatement of any “timeliness” penalties incurred on individual income tax returns (Form 540, Form 540NR, Form 540 2EZ) for tax years beginning on or after January 1, 2022.

- It’s only available to individual taxpayers subject to personal income tax law (so estates, trusts, and fiduciaries aren’t eligible).

- It can be requested verbally or in writing starting on April 17, 2023.

- For California taxpayers who qualify for an extended 2022 income tax return due date because of the California Winter Storms (i.e., most California taxpayers), the "timeliness” penalties that would be abated through this program should not start being imposed until after the new extended due date for that tax year - October 16, 2023.

Which penalties are eligible?

Both the Failure to File Penalty (i.e., you did not file your tax return by the due date nor did you pay by the due date of your tax return) and the Failure to Pay Penalty (i.e., you did not pay the entire amount due by your payment due date) on California individual income tax returns for tax years beginning on or after January 1, 2022 are eligible for the one-time penalty abatement.

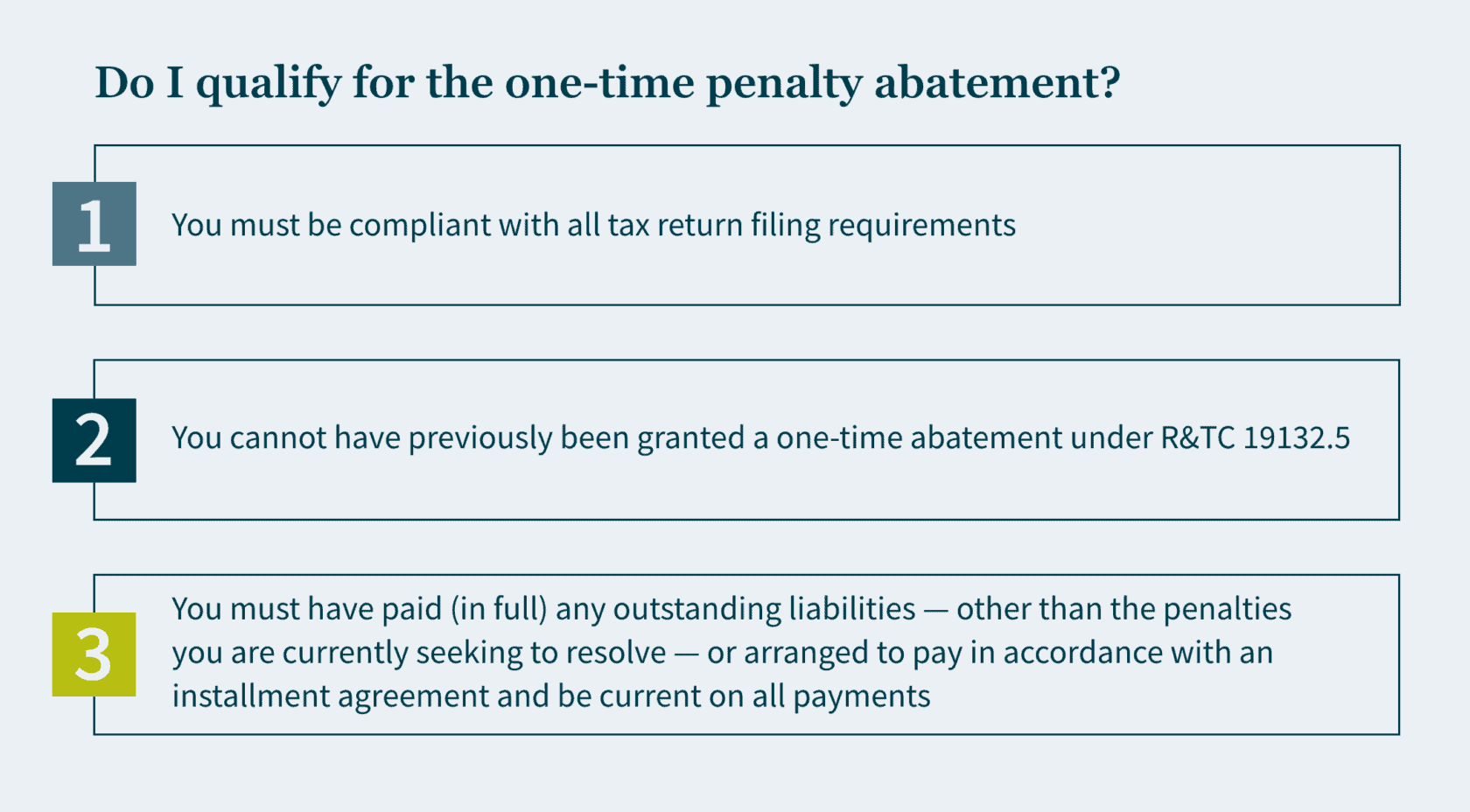

How do I qualify?

How do I request a one-time penalty abatement?

You can mail in a completed Form FTB 2918 or call the FTB at +1 (800) 689-4776 to request penalty abatement.

What if I can provide that I had reasonable cause for late filing or late payment?

If you can demonstrate that you exercised ordinary care and prudence and were nevertheless unable to file your return or pay your taxes on time, then you may qualify for penalty relief due to reasonable cause. Reasonable cause is determined on a case-by-case basis and considers all the facts of your situation.

You may request penalty abatement based on reasonable cause by mailing in a completed Form FTB 2917 or by filling out a reasonable cause request on your MyFTB online account. Penalty abatement based on reasonable cause may – depending on the circumstances – be preferable to using up your one-time penalty abatement request.

How we can help

If you need help with relief for your "timeliness" penalties or if you need help with any other state and local tax matters, please reach out to our experienced State and Local Tax team.