Critical Decisions Facing Tribal Nations in 2021

Tribal nations across the United States face ongoing and unique challenges. The COVID-19 pandemic has hit Tribal communities the hardest, and although government grants were available, accounting for the support programs is cumbersome and complex. Add to that constant cybersecurity threats coupled with the need to diversify investments in the post-pandemic economy, and you have a high-risk environment. It is a good time for leaders to evaluate their internal resources capabilities to tackle these issues, prioritize risks, and develop a roadmap to a more stable future.

Prepare for grant reporting

The total distribution of government grants for Native American Tribes is estimated to be more than $31 billion. Being awarded a grant is a welcomed relief, however organizations must ensure that the proper grant accounting and compliance guidance are followed. This requires time, energy, systems, and often an increase in internal efforts. Furthermore, for some organizations initial grant awards may trigger new audit requirements and reengineering of existing accounting procedures.

Grant requirements can be complicated, so it is crucial to develop a systematic grant management program. Identify (or hire) a grant administrator to take responsibility for meeting compliance guidelines. Develop policies and procedures that outline each step in the lifecycle of a grant (application, interim reporting, and final results). Grant reporting involves many deadlines and needs consistent attention and clear communication with the granting agency. Close attention to the reporting and compliance details of the grant will make final reporting or an audit of the grant much easier. But it’s not just ease that is important, solid grant compliance and grant management is about good fiscal management, transparency, and mitigating risk. Because the consequences of noncompliance can be fines, costs to reputation, and a loss of confidence from funders.

Secure your assets against cybercrime

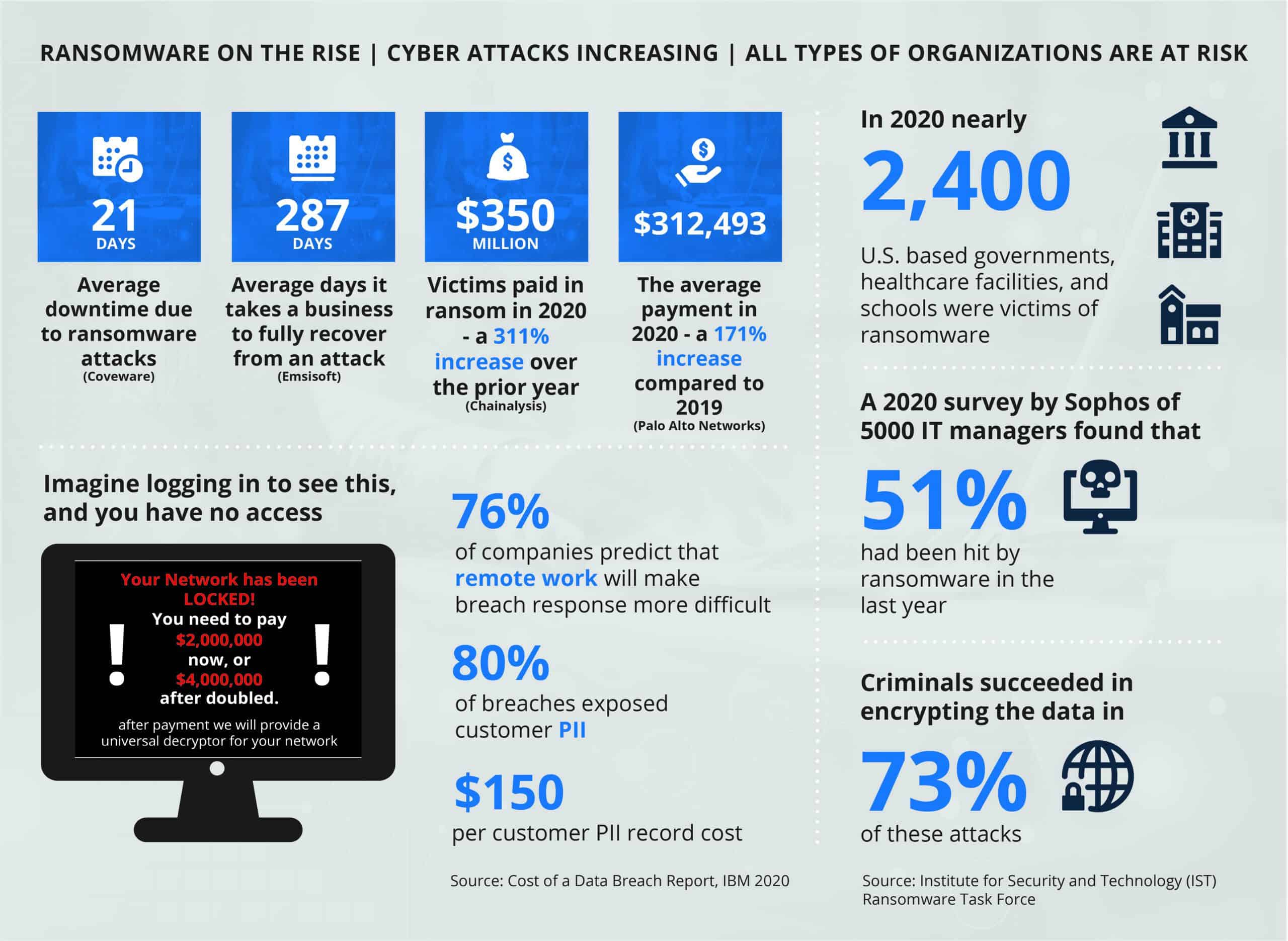

Cybersecurity should be another priority for tribal communities. Casinos and gaming organizations are high-value targets for cyber criminals because of the large quantity of Personal Identifiable Information (PII) obtained and stored on a daily basis. Casinos also have many physical and digital entry points, a variety of technology, a large workforce, multiple third- party vendors, and high frequency of high cash and payment card transactions. These components entice cyber criminals to launch large scale attacks and potentially cause expensive data breaches.

How do you protect yourself in an industry that is so ripe for cybercrime? A formal risk assessment can gather disparate pieces of information and evaluate your entire environment including the mix of digital computing platforms. This will help you prioritize the issues you need to address to build a more secure structure in which to do business. A comprehensive risk assessment will also help assess your compliance and controls and identify your full range of risk exposure.

It’s also crucial to understand what assets you have so you know what must be protected. These include more than just laptops or servers. Your cloud, web applications, and mobile devices are also at risk. Gap analysis and a penetration test can reveal the vulnerabilities in your IT environment.

Once you’ve fully identified your vulnerabilities, you can take actions to strengthen your defenses and protect your business. Ultimately, you will need to identify the leaders responsible for managing cybersecurity risks, suggesting methods and resources for mitigation, providing training, and developing an executable cyber security roadmap in order to move forward.

A diversified portfolio reduces risk

Both individuals and organizations need a diverse group of investments to spread out risk. This is not news, but frequently, the awareness of risk does not result in actions that mitigate it.

Finding the right investments takes time. A financial advisor can help you, but ultimately the decisions are yours. Do you look for high returns? Not if you are looking to balance your risk. Do you seek out the predictability of bonds? There are actually risks in that approach, too. There is no single way to mitigate risk, but examining your current investments is a good place to start before evaluating new ones.

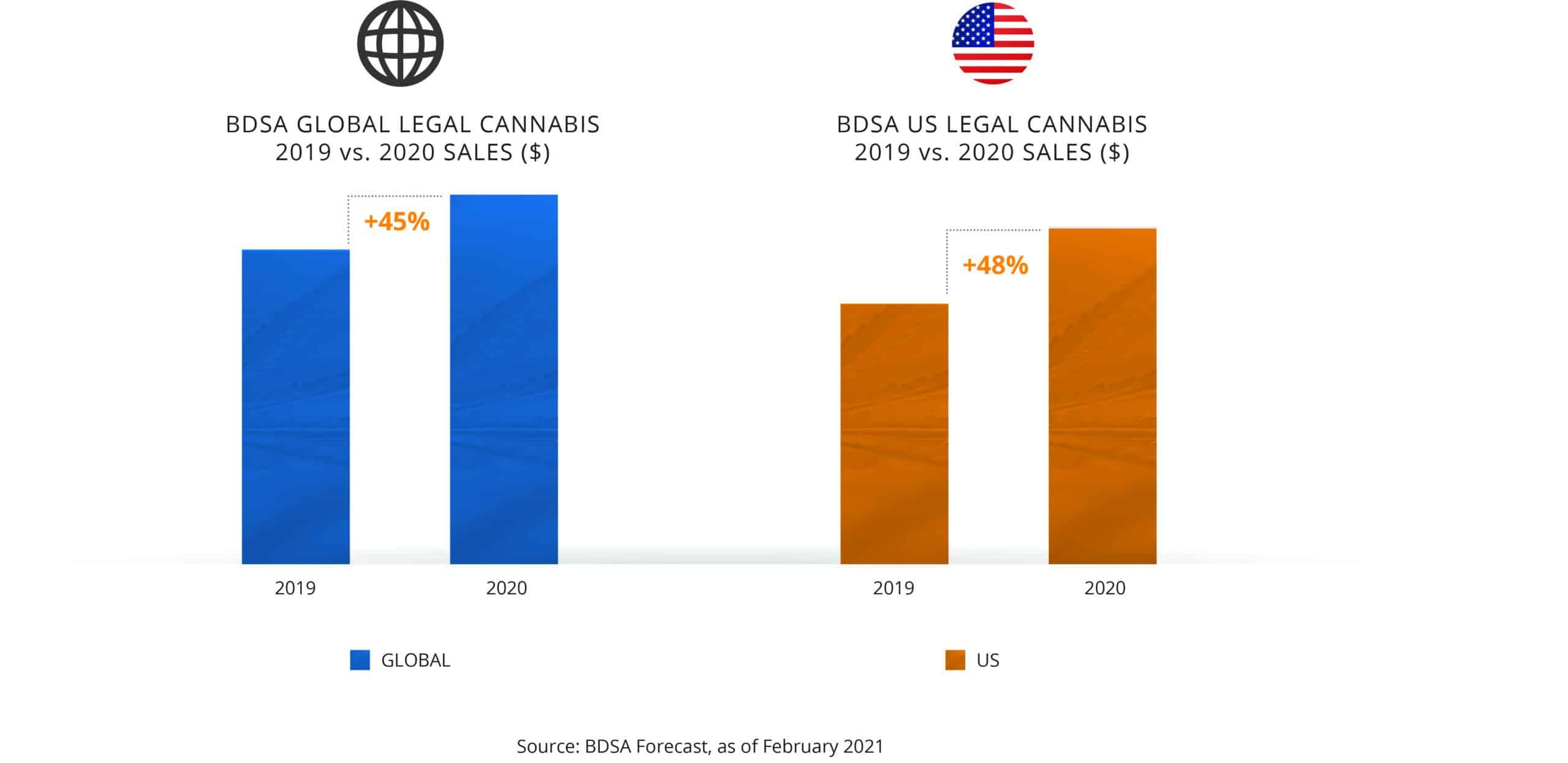

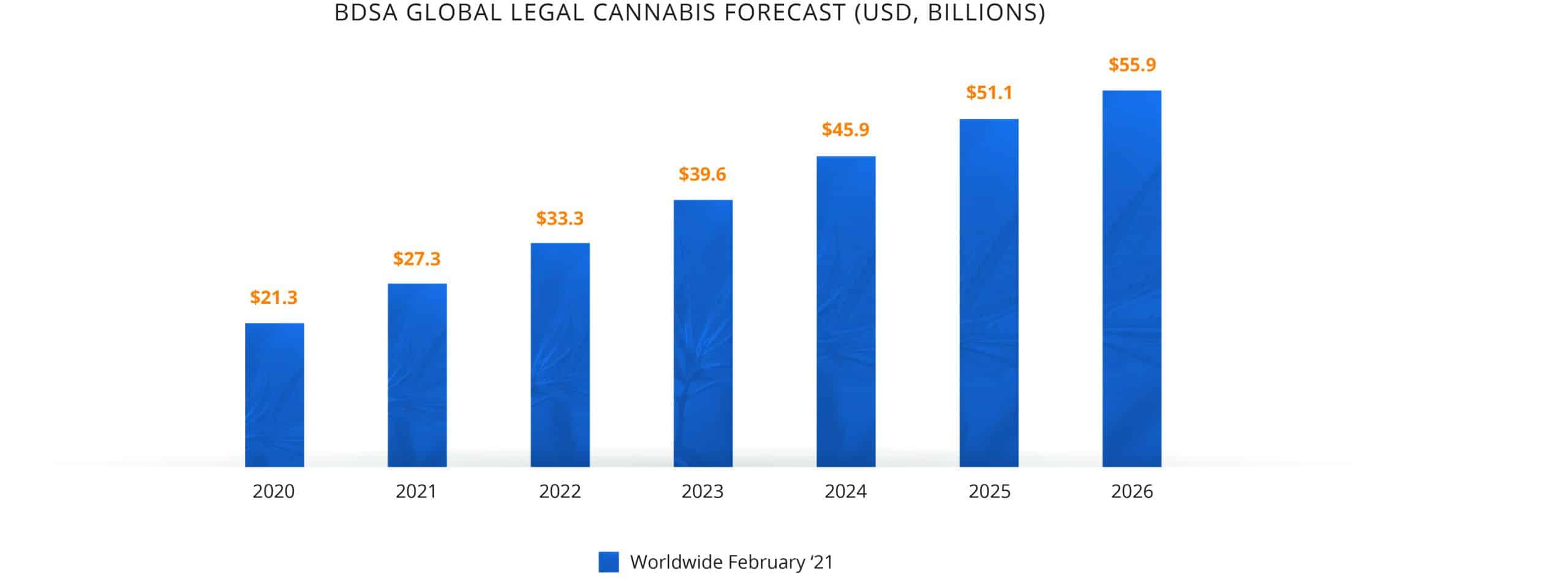

When it comes to diversifying your portfolio, take your time to do the due diligence. For instance, the cannabis industry is one of the fastest-growing industries in the world. It will generate an estimated $146.4 billion by 2025, according to Grand View Research. Does that make it the right opportunity for you? To find the answer, you need to dig deeper.

The industry is still in its early stages of growth, and this can work in your favor. Your investment could grow quickly, but regulations and licensing can be complicated for an emerging industry. Cannabis may be an exciting and profitable business to get involved in, but that doesn’t mean it is it the right investment for your particular portfolio. If you are trying to mitigate risk, does this investment really accomplish that? Do you already have a high-growth investment? Are there stigmas associated with cannabis that you might want to avoid? Are there compliance issues that could be more of a headache than investing in a more mature industry?

An investment in cannabis may not be a simple decision. Like many industries, you can also decide how deeply you want to invest — and there are risks at each level. An investor could focus on cultivation, manufacturing, retail, or the development of a vertically integrated cannabis operation. The unique sovereignty of Tribal nations even creates potential for leasing Tribal land to cannabis cultivators or aspiring cultivators without land to grow.

Like any investment, due diligence is key to risk mitigation. If you understand the industry you are investing in, you will understand your investment’s impact on your portfolio. And remember, when considering risk, your focus should be on your overall portfolio, rather than the intriguing possibilities of the industry or the certainty of returns.

How we can help

Tribal leadership is facing unique challenges. More than ever, sound due diligence and risk mitigating practices must be an integral part of decision making. MGO’s professionals have helped Tribes develop frameworks for grant management, cybersecurity, and economic diversification that facilitate the decision-making process for council members.