Countdown to Corporate Transparency Act Reporting: Is Your Business Prepared?

Executive Summary:

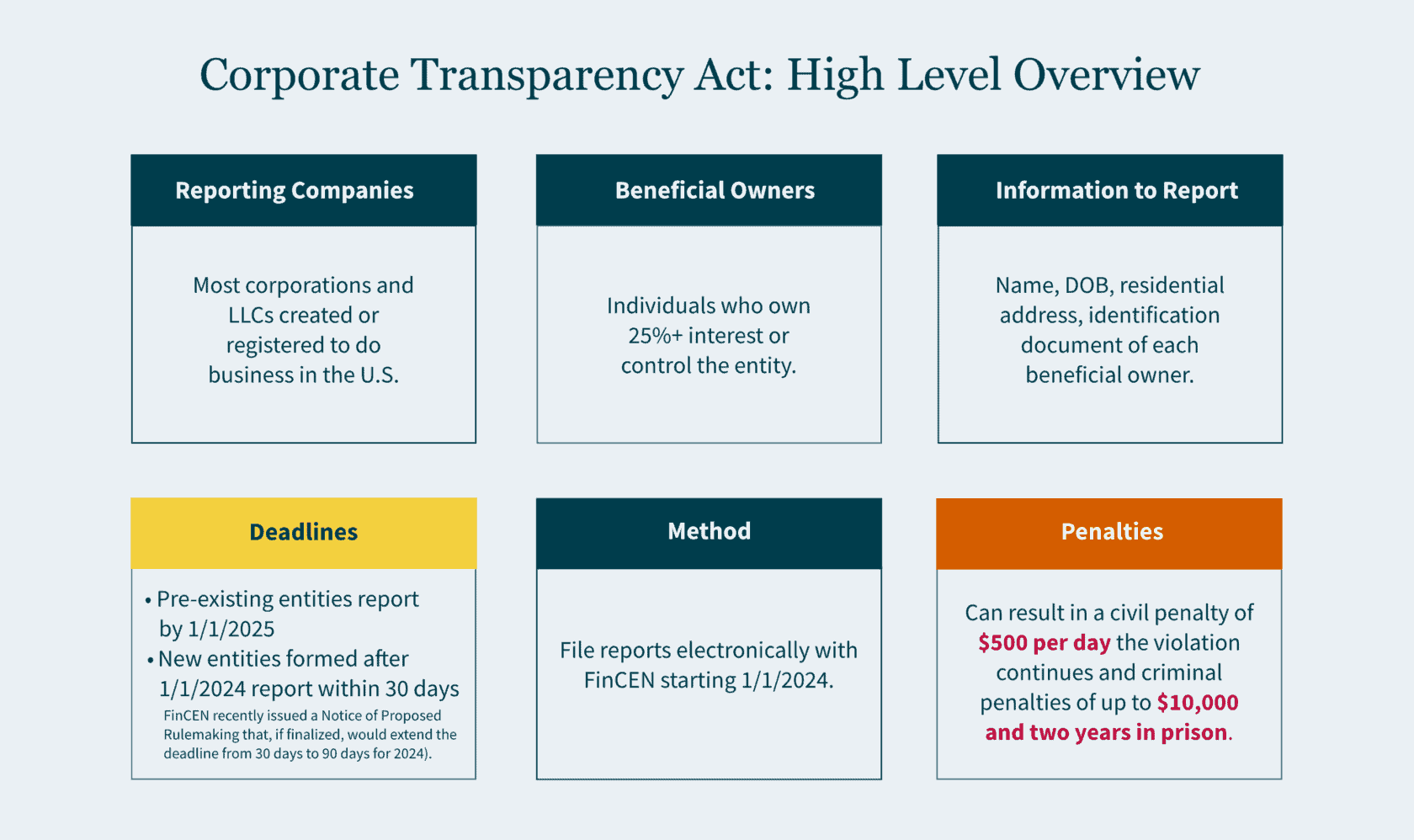

- The Corporate Transparency Act (CTA) will require millions of companies (that will be organized or created on or after January 1, 2024) to disclose ownership information to the government starting in 2024. Exemptions exist for certain types of entities.

- "Beneficial owners" who must be reported include those with a 25%+ ownership interest or "substantial control" of the company. Required data that must be provided includes names, DOBs, addresses, and a unique identifying number and issuing jurisdiction from an acceptable identification document (and the image of such document).

- Existing companies (those created before January 1, 2024) must file by January 1, 2025. Non-compliance can result in a civil penalty of $500 per day the violation continues and criminal penalties of up to $10,000 and two years in prison.

~

If your corporation or LLC does business in the United States, the clock will soon start ticking for you to report information about your ownership to the U.S. government. As a result of the newly implemented Corporate Transparency Act (CTA), beginning in January 2024, companies will be required to file a Beneficial Ownership Information (BOI) report with the Department of the Treasury's Financial Crimes Enforcement Network (FinCEN).

For those who may be unaware or are just getting up to speed on the new CTA requirements, this is a filing you need to have on your radar for a few reasons:

- It is broad-reaching and affects millions of companies;

- It may require action on your part in the coming year; and

- The consequences of non-compliance can be costly and even severe for your business and ownership team.

Given the importance of this reporting requirement and the possibility of significant penalty exposure, we want to highlight below some of the important aspects of the beneficial ownership interest (“BOI”) reporting requirement.

We want to emphasize that the CTA mandate and supporting materials are detailed and legal in nature. We advise you to seek legal guidance for your own specific BOI reporting compliance needs.

As MGO is an accounting firm, we are unable to prepare or assist with these filings. However, if you do not have legal counsel to assist you with this, we can introduce you to legal counsel and/or other service providers who may be able to help you with your reporting needs.

Using Data Collection to Combat Money Laundering and Terrorism Financing

Enacted in 2021 as part of the National Defense Authorization Act, the Corporate Transparency Act was created to help detect and prevent tax fraud, money laundering, and other financial crimes. The act aims to weed out malicious actors trying to conceal corporate ownership by making ownership disclosure a federal requirement.

The CTA is the first law to require business entities to disclose beneficial owners to the government. Businesses will need to identify information about their beneficial owners and file reports with the federal government – a potentially complex process requiring organizations to comply by a set deadline or face stiff penalties.

Anticipating the initial confusion that will swirl around this new requirement, FinCEN – the bureau of the U.S. Department of the Treasury tasked with managing the collection of ownership information – has proactively published information and resources about BOI reporting to its website. This includes videos, frequently asked questions, and a small entity compliance guide.

CTA Preparation: Understanding How Reporting Requirements Apply to Your Business

The first step in preparing for CTA reporting is understanding how it will affect your organization. Here are the critical aspects you need to know about the new CTA requirement:

Only “reporting companies” need to file beneficial ownership information

Emerging with the CTA is a new set of terms your organization will need to add to its lexicon. One of those terms is “reporting company”, which is any non-exempt company that must file a BOI report. Reporting companies fall into one of the two buckets below:

- Domestic Reporting Companies: Entities such as corporations and limited liability companies (LLCs) created by filing documents with a secretary of state or similar authority within the United States.

- Foreign Reporting Companies: Entities formed under the law of a foreign country and registered to do business in the United States by the filing of a document with a secretary of state or similar office under the laws of a state.

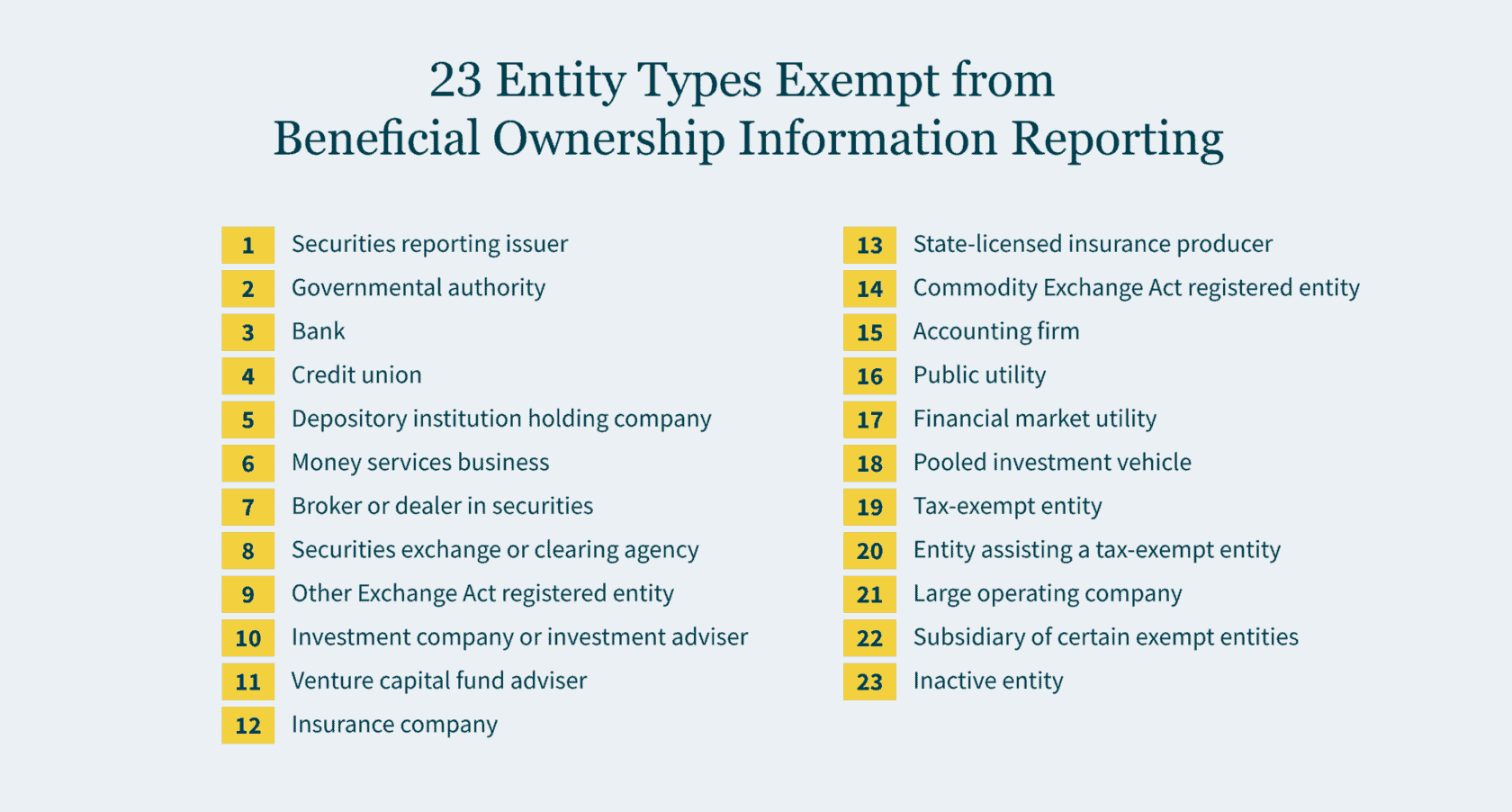

While the CTA places reporting requirements on many businesses, the act grants exemptions to 23 types of entities, including (but not limited to):

- Publicly traded companies

- Banks and credit unions

- Nonprofit organizations

- Government entities

- Inactive entities meeting specific criteria

- Large operating companies

- Pooled investment vehicles

- Investment companies

Most trusts are also not currently categorized as reporting companies since they don’t file formation documents – though that rule could change in the future.

Understanding whether your organization qualifies for CTA exemptions can potentially save your company unnecessary time, effort, and frustration. While some of the exemption categories are straightforward – covering organizations that already provide ownership-identifying information to the public or government – others warrant closer examination to determine if your organization is eligible.

For example, “Large operating companies” is an exemption that may be applicable to many businesses. This designation hinges on meeting three key criteria: (1) more than 20 full-time employees in the U.S. (with “full time” defined as working 30 hours or more); (2) U.S. gross receipts or sales (net of returns and allowances) of more than $5 million from the previous year; and (3) having a physical office location in the U.S. that the entity owns or leases (that is not a residence or shared space).

Identifying information must be provided for each “beneficial owner”

A central concept in CTA compliance is reporting "beneficial owners". Beneficial owners are individuals who either:

a) Own or control 25% of the company, or

b) Exercise substantial control.

FinCEN clarifies “substantial control” to mean serving as senior officer, having authority to remove the senior officer or majority of the board of directors, or wielding the ability to influence important decisions. It is possible to have a reporting company where no individual owns a 25% or greater interest, but it is not possible to have a reporting company where no one has “substantial control”.

For each beneficial owner, your company will be required to provide:

- Name

- Date of birth

- Residential address

- Identifying number from identification document such as a passport or U.S. driver’s license

- Image of identifying document

When submitting your BOI report, you will also be required to provide company information (legal name, trade or DBA name, principal U.S. address, jurisdiction of formation, TIN) and information about the individual submitting the application.

Ownership information will not be made public, but certain entities will have access

After you have submitted your BOI, who will be able to access it? This is the question on the minds of many business owners. There are various personal, legal, and financial reasons why a business owner may prefer to keep his or her ownership private. The CTA regulation will likely raise concerns from owners who value anonymity.

According to FinCEN, ownership information “will be stored in a secure, non-public database using rigorous information security methods and controls typically used in the Federal government to protect non-classified yet sensitive information systems at the highest security level”.

Other than FinCEN, there are five groups that may be permitted to access beneficial ownership information in its database:

- Federal agencies engaged in national security, intelligence, or law enforcement activity

- State, local, and tribal law enforcement agencies to seek information in a criminal or civil investigation

- Foreign officials who submit a request through a U.S. federal government agency

- Financial institutions with the consent of the reporting company

- Federal functional regulators (e.g., Federal Reserve, FDIC, SEC) in certain circumstances

Existing and newly created companies have different CTA reporting deadlines

FinCEN will begin accepting BOI reports on January 1, 2024. All companies required to submit a BOI will do so electronically through a secure filing system on FinCEN’s website. There is no fee for filing this report. There are two different BOI deadlines business owners and operators need to be aware of – one for existing businesses and one for newly created businesses:

- Existing companies (created/registered before January 1, 2024) must file BOI reports by January 1, 2025

- New companies (created/registered after January 1, 2024) must file within 90 days of registration.

Non-compliance with the CTA can result in a civil penalty of $500 per day the violation continues and criminal penalties of up to $10,000 and two years in prison. Correcting omissions or errors within 90 days of the deadline may enable companies to avoid penalties.

Start Planning Now to Ensure Your Company is CTA Compliant

The Corporate Transparency Act introduces significant changes to reporting company ownership information. Understanding your obligations and staying informed about CTA developments is essential for navigating this new regulatory landscape while safeguarding your business interests.

As noted earlier, we advise you to seek legal counsel to fulfill this new requirement properly. We can refer you to legal counsel and/or other service providers if you do not already have counsel.

Additional information on the beneficial ownership reporting requirement can be found on the FinCEN website. Their FAQ is a good starting place.

We can be available if you have any general questions on this reporting requirement. If you have questions about how CTA requirements will impact your business, reach out to the professionals at MGO today.