Key Takeaways:

- Stay compliant with CalSavers to protect your business from fines.

- CalSavers requires employers to offer retirement savings or enroll employees in the state program.

- The CalSavers compliance deadline has passed, but small businesses and nonprofits that have not yet registered can still take action to reduce penalty risk.

—

It’s crucial for California employers (including nonprofits and employers of household help) to stay updated with the evolving regulatory landscape — particularly regarding retirement savings programs.

Created to provide all California workers with access to retirement savings, the CalSavers Retirement Savings Program places specific responsibilities on employers. If you are an employer in California, it’s important to understand your obligations under this program to avoid potential penalties and maintain compliance.

What Is CalSavers?

CalSavers is a state-administered retirement savings program that requires California employers who do not offer a qualified retirement plan to facilitate employee participation in the program. The program is designed for workers who lack access to a retirement plan through their employers.

There are no employer fees, no employer contributions, and no fiduciary responsibility.

The savers account is a Roth IRA (after tax) that is set up in the employee’s name and funded through payroll deductions. The default savings rate is 5% of gross pay. Savers can change their rate at any time. The savers account is portable — meaning it stays with individuals even if they leave your workplace.

Why Must I Comply?

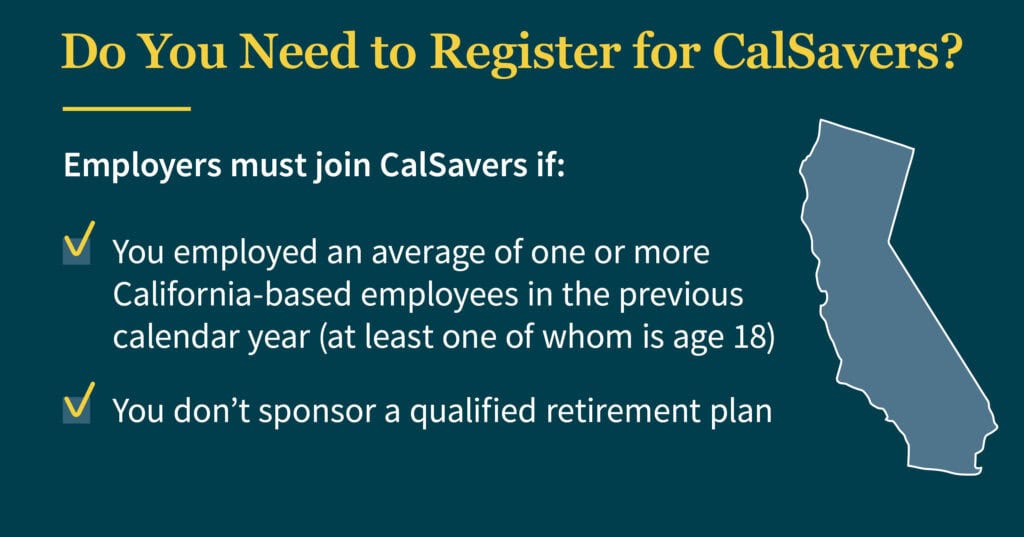

The CalSavers program has expanded to include California employers with an average of four or fewer employees who do not already offer a qualified retirement plan. Previously limited to larger employers, the program now requires smaller employers without an alternative retirement plan to either facilitate employee enrollment in CalSavers or offer a qualified plan.

The deadline for compliance was December 31, 2025. If you missed this deadline, registering as soon as possible may help limit penalties.

Key Responsibilities for Employers

As an employer, your primary responsibilities under CalSavers include:

- Registering with CalSavers: Employers must register with the CalSavers program by the required deadline. Registration can be completed through the CalSavers Employer Portal. Missing the registration deadline can lead to penalties.

- Employee enrollment: After registration, employers must upload a roster of eligible employees to the CalSavers system. Employees are eligible to participate from the first date they are hired. Employers are responsible for informing employees about the program and enrolling them unless they opt out.

- Payroll deductions: Employers must facilitate payroll deductions for employees who choose to participate. This involves setting up the appropriate payroll deductions and ensuring timely and accurate contributions to the employees’ IRAs.

- Ongoing compliance: Employers must stay compliant with ongoing reporting requirements. This includes regularly updating employee information, managing contributions, and offering new hires the opportunity to participate in CalSavers within 30 days of their hire date.

Compliance Deadlines

CalSavers deadlines vary based on the size of your business. Larger organizations (five or more employees) were required to comply by December 31, 2024, while organizations with 1-4 employees were required to comply by December 31, 2025. Organizations that do not employ any individuals other than the owners are exempt from the registration mandate.

Penalties for Non-Compliance

Non-compliance with CalSavers can result in significant penalties. Employers who do not meet registration or payroll contribution requirements may face fines starting at $250 per eligible employee if non-compliance extends beyond 90 days after receiving a notice. An additional $500 per eligible employee may be imposed if non-compliance continues beyond 180 days.

Steps to Achieve Compliance

When considering your options, it is important to evaluate whether setting up your own qualified retirement plan might be a better alternative to enrolling in CalSavers.

- Review your current retirement offerings: Decide if your existing retirement plan qualifies under CalSavers or if you need to enroll in the state program. Establishing your own qualified retirement plan could offer more tailored benefits and meet compliance requirements — potentially serving as a better option than CalSavers. However, for some employers, CalSavers might be a more cost-effective solution. It is advisable to carefully assess these alternatives to determine the most suitable path forward for your business.

- Register with CalSavers: If you don’t have a qualified plan, register your business with CalSavers through their online portal.

- Educate your employees: Help your employees understand their options under the CalSavers program, including how they can opt out if they choose.

- Set up payroll deductions: Work with your payroll provider to set up the necessary deductions for employees who choose to participate in CalSavers.

- Stay updated: Keep track of ongoing compliance requirements to avoid penalties.

Need Help?

Navigating the complexities of CalSavers can be challenging, especially for small and mid-sized businesses. MGO offers support to help you understand your obligations, achieve compliance, and avoid costly penalties. Reach out to our team today for personalized assistance tailored to your business needs.