Key Takeaways:

- Aligning international tax strategy with global supply chain planning helps reduce tax exposure, capture incentives, and increase operational agility.

- Ignoring exit taxes, transfer pricing, or cross-border compliance risks can create multi-year tax liabilities, penalties, and restructuring costs.

- Involving tax leaders early in global supply chain restructuring leads to smarter decisions, improved timelines, and long-term business scalability.

—

In today’s dynamic global business environment, aligning your organization’s international tax planning with supply chain planning strategy isn’t just a best practice — it’s essential. From shifting trade relationships and tariffs to increased scrutiny from global tax authorities, your company’s ability to make tax-informed supply chain decisions can directly impact cash flow, risk profile, and competitive positioning.

Here’s how your tax and operations leaders can collaborate to build a globally agile structure, and why international tax strategy must be at the core.

Why International Tax Strategy Must Drive Global Supply Chain Decisions

Mid-market organizations are rethinking their operational footprint — reshoring, nearshoring, or diversifying supplier bases. But without a clear international tax lens, these shifts can trigger unintended consequences: exit taxes, loss of treaty benefits, or transfer pricing risks.

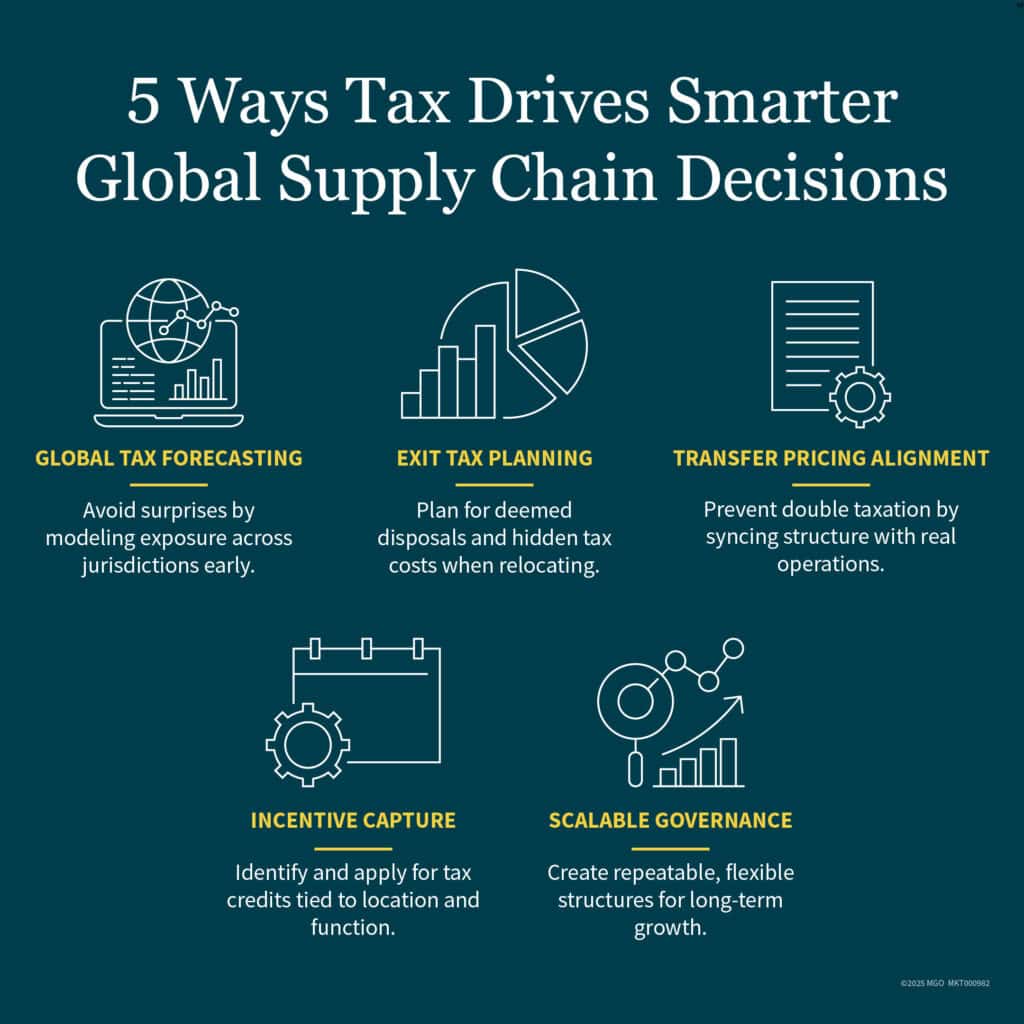

A tax-aligned supply chain strategy allows you to:

- Forecast and manage global tax liabilities

- Capture incentives and avoid inefficiencies

- Make faster, more informed decisions across jurisdictions

Integrate International Tax Early in the Planning Process

Waiting until after operations moves are underway can leave your business with a fragmented tax structure that requires costly remediation. This is especially critical for mid-market companies operating across the U.S., EMEA (Europe, the Middle East, and Africa), or APAC (Asia-Pacific) regions, where cross-border structuring can create unexpected tax burdens. Tax should be involved from the outset — modeling scenarios across jurisdictions, projecting costs, and identifying risk exposure.

For example:

- Moving production from China to Mexico might avoid certain tariffs — but could expose your business to exit taxes in China or permanent establishment risk in Mexico.

- Relocating intellectual property (IP) from Ireland to the U.S. might trigger a deemed disposal event under local exit tax regimes.

Technology platforms and predictive models can help tax teams simulate these impacts before major decisions are finalized.

Strengthening Transfer Pricing and Global Compliance

Global tax authorities are tightening enforcement — especially around transfer pricing and cross-border restructurings. If your tax structure no longer reflects your actual operations, you may face:

- Double taxation

- Disallowed deductions

- Penalties and disputes

Update your transfer pricing documentation to reflect the new supply chain model. Intercompany agreements, economic analyses (including IP valuation), and jurisdictional reporting must all align with your post-transition structure.

Unlock Incentives Through Coordinated Strategy

Supply chain shifts aren’t just about avoiding risk — they’re also an opportunity to capture new value. Jurisdictions including the U.S., Canada, Mexico, and certain European Union countries offer targeted tax incentives for reshoring, green investment, R&D, or job creation.

If these incentives aren’t launched early in planning, your business could miss out. Tax should coordinate with operations and finance teams to explore:

- U.S. federal and state credits for manufacturing investment

- R&D credits tied to newly localized functions

- Foreign tax credits or deferrals available in new jurisdictions

Create a Globally Scalable Tax Playbook

Reactive tax planning doesn’t scale. As your organization enters new markets, integrates M&A targets, or adds new suppliers, your international tax model must be flexible and supported by a clear global tax governance framework.

A forward-looking playbook helps you:

- Align tax structure with business decisions

- Build global tax governance into location changes, IP moves, and new legal entities

- Reduce friction during rapid growth or operational transformation

The Path Forward: Strategy, Agility, and Risk Reduction

International supply chain restructuring can unlock efficiency, improve margins, and reduce geopolitical exposure — but only if tax is at the table from the start.

Organizations that treat tax as a strategic partner rather than a compliance function are better positioned to navigate volatility and create long-term value.

How MGO Can Help

At MGO, we help companies navigate the complexities of global tax strategies and cross-border operations. From international structuring and transfer pricing to tax technology and incentive optimization, we serve clients across manufacturing, life sciences, technology, and more.

We work closely with CFOs and tax executives to align tax planning with business transformation — supporting global agility, regulatory compliance, and strategic growth. Let’s talk about how your international tax strategy can support your global operations.